1. Introduction #

This guide explains how automating TradingView strategies for options in TradeStation works, from broker connection to strike, expiry, SL/TP, and multi-account execution. Automating TradingView strategies for options allows for faster, rules-based execution in TradeStation without manual input.

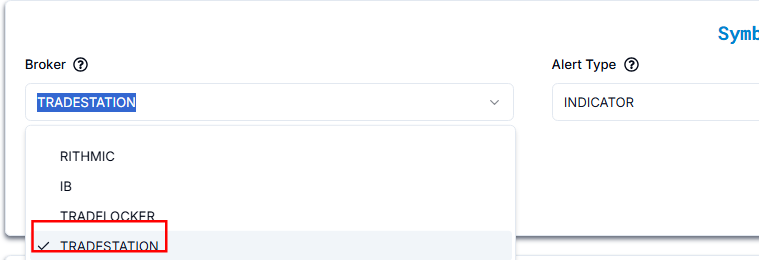

2. Select TradeStation as Your Broker in PickMyTrade #

- Broker: Select TradeStation from the PickMyTrade broker list.

- Ensure your TradeStation account is connected and authorized via secure login or API credentials.

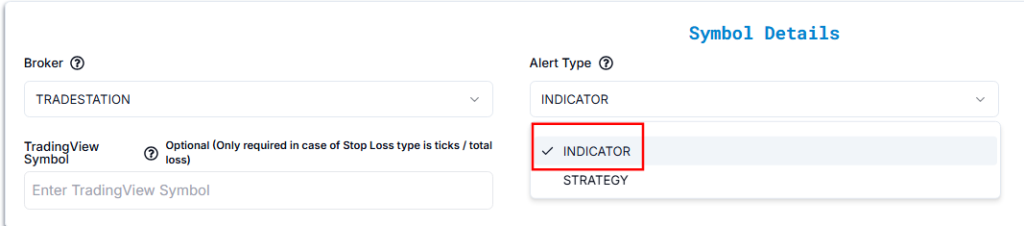

3. Choose Strategy or Indicator Alert Type in TradingView #

Alert Type Options # #

| Alert Type | Description |

| INDICATOR | Alerts based on technical indicators (e.g., RSI, Moving Averages). |

| STRATEGY | Alerts based on predefined trading strategies in TradingView. |

We have selected INDICATOR as our preferred alert type.

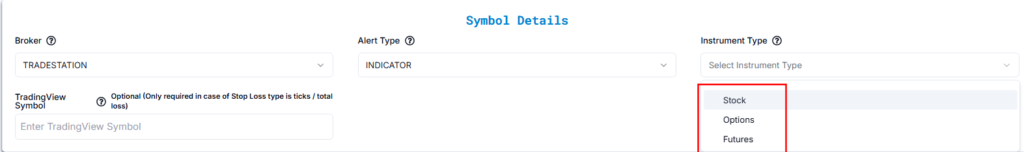

4. Choose Asset Type for Trade Execution in TradeStation #

Select the appropriate instrument type based on what you’re trading:

- Stocks – For equity shares like AAPL, MSFT, etc.

- Futures – For standard futures contracts like MNQ, ES, etc.

- Options – For equity options like AAPL Calls and Puts.

In this setup, we are selecting Options because we are automating trades for AAPL options.

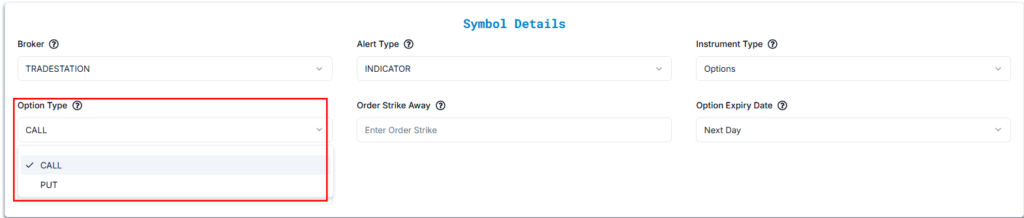

5. Select Call or Put Option Type for TradeStation Orders #

| Setting | Explanation | Example |

| Call | Expecting the stock price to rise. | Buying an AAPL Call when the stock price is at $150, expecting it to go higher. |

| Put | Expecting the stock price to fall. | Buying a TSLA Put when the stock price is at $700, expecting it to drop. |

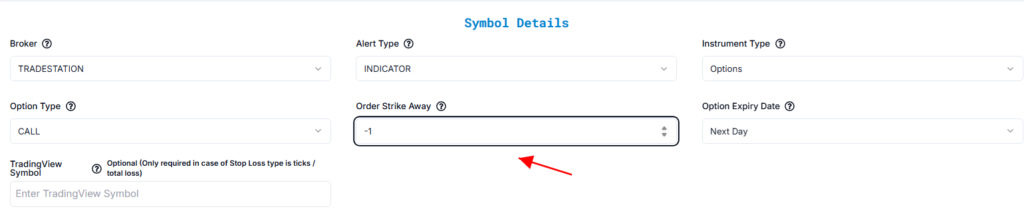

6. Set Strike Price Logic for Option Alerts in TradingView #

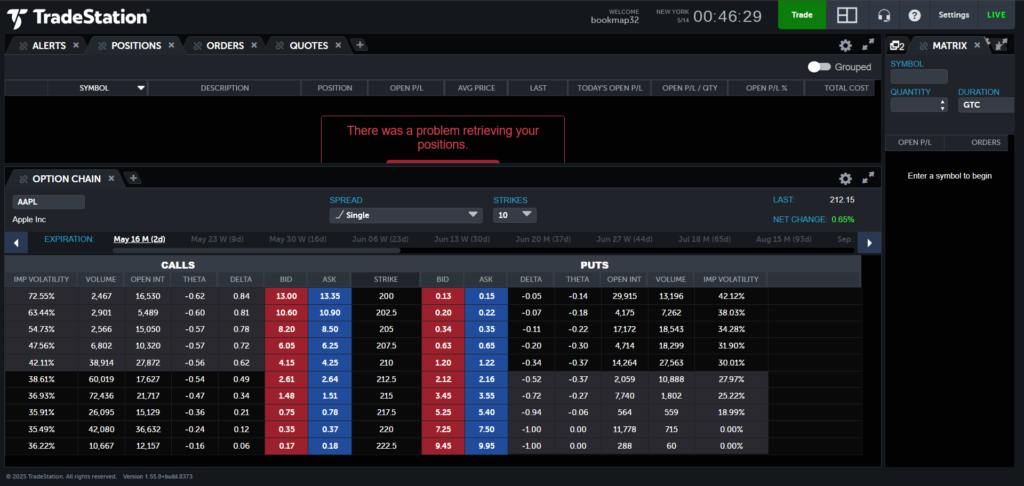

Strike Price Settings (Updated for AAPL @ $212.15) #

| SETTING | EXPLANATION | EXAMPLE (AAPL @ $212.15) |

|---|---|---|

| Strike Away | Defines how far the strike is from the market price. | Strike Away: 2 → Call strike: 214.15, Put strike: 210.15 |

| At-the-Money (ATM) | Strike price is closest to the market price. | Call & Put strike: 212.5 |

| In-the-Money (ITM) Calls | Strike below the market price (option has intrinsic value). | ITM Call strikes: 210, 207.5, 205… |

| In-the-Money (ITM) Puts | Strike above the market price (option has intrinsic value). | ITM Put strikes: 215, 217.5, 220… |

| Out-of-the-Money (OTM) Calls | Strike above the market price (no intrinsic value). | OTM Call strikes: 215, 217.5, 220… |

| Out-of-the-Money (OTM) Puts | Strike below the market price (no intrinsic value). | OTM Put strikes: 210, 207.5, 205… |

Visual Reference (from screenshot):

- AAPL Last Price: 212.15

- Closest strike: 212.5

- Call Bid/Ask at 212.5: 2.61 / 2.64

- Put Bid/Ask at 212.5: 2.13 / 2.16

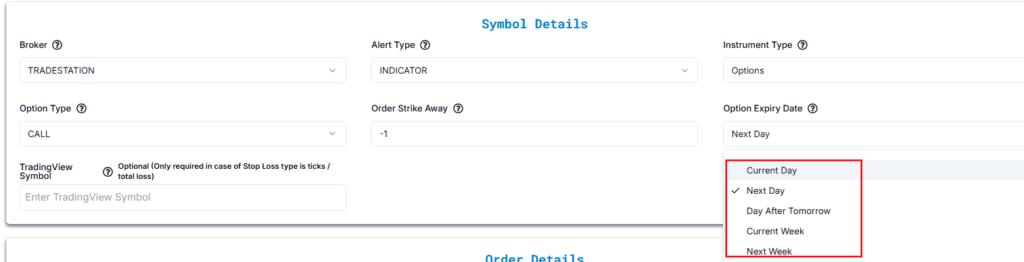

7. Configure Option Expiry Dates for AAPL Options in TradeStation #

Select relative expiry using the current date for reference (e.g., May 14, 2025):

8. Option Expiry Date # #

| Expiry Type | Easy Explanation | Example (AAPL Call Option, Today is May 14, 2025) |

|---|---|---|

| Current Day | Ends today, May 14, 2025. | Buy call option, expires at close of May 14, 2025. |

| Next Day | Ends tomorrow, May 15, 2025. | Buy call option, expires at close of May 15, 2025. |

| Day After Tomorrow | Ends in 2 days, May 16, 2025. | Buy call option, expires at close of May 16, 2025. |

| Current Week | Ends this week, May 16, 2025. | Buy call option, expires at close of May 16, 2025. |

| Next Week | Ends next week, May 23, 2025. | Buy call option, expires at close of May 23, 2025. |

| Current Month | Ends this month, May 30, 2025. | Buy call option, expires at close of May 30, 2025. |

| Next Month | Ends next month, June 28, 2025. | Buy call option, expires at close of June 28, 2025. |

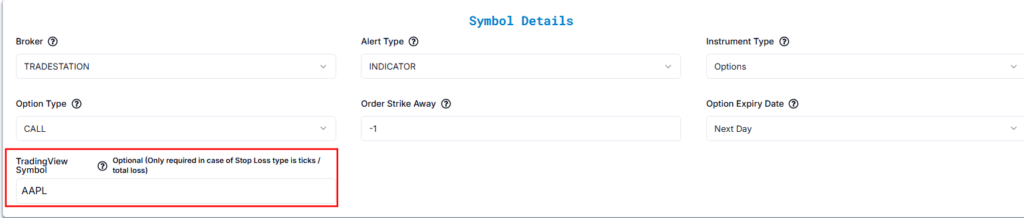

8. Enter the Correct TradingView Symbol for Accurate Mapping #

- TradingView Symbol:

AAPL - Use Case: Only required when your Stop Loss type is based on:

- Ticks

- Total Loss

- This field connects your TradingView strategy to the correct instrument for SL calculations.

9. Define Strategy Exit Logic (TP1, TP2) for Alert Execution #

Confirm Exit Handling

| Question | Answer |

|---|---|

| Does your strategy have multiple exits like TP1, TP2? | No |

| Would you like to place SL/TP with each order in TradeStation? | Yes |

If your strategy supports multiple take-profits, PickMyTrade can execute them, but only one TP/SL can be attached to entry orders per TradeStation’s limitation.

If No, you must manually configure SL/TP inside PickMyTrade.

Stop Loss / Take Profit / Breakeven Type: Refer to the SL/TP configuration section for detailed settings. Click here.

10. Account Selection and Configuration for TradeStation #

Would you like to add multiple accounts or select a specific account for trade execution?

Yes

Upon selecting Yes, additional configuration fields become visible to connect your TradeStation accounts and define execution parameters.

10.1 Add TradeStation Account to Current PickMyTrade Login #

| Field Name | Example Input | Explanation |

|---|---|---|

| PickMyTrade Conn. Name | TRADESTATION1 | Choose the correct connection name from the dropdown. |

| TradeStation Acc. Name | SIM155568455M | Select your TradeStation account. |

| Option | QUANTITYMULTIPLIER | Choose your sizing method. |

| Qty Multiplier | 1 | If multiplier is 2, a trade for 5 contracts becomes 10. |

10.2 Add TradeStation Account to Another PickMyTrade Account #

This is useful when managing trades from one account into another PickMyTrade login.

| Field Name | Example Input | Explanation |

|---|---|---|

| PickMyTrade Token | abcd1234xyz | The token from the target PickMyTrade account. |

| PickMyTrade Conn. Name | TRADESTATION1 | Same as used in the target account. |

| TradeStation Acc. Name | SIM155568455M | Enter exactly as it appears in TradeStation. |

| Option | QUANTITYMULTIPLIER | Choose the sizing method. |

| Qty Multiplier | 1 | Multiplies all trade quantities as needed. |

Ensure the connection name and token match exactly, or trade execution may fail. Whether you’re using a single or multi-account setup, automating TradingView strategies for options ensures consistent trade execution logic across TradeStation accounts.

Generate Alerts in TradingView for TradeStation Execution via PickMyTrade #

Click on “Generate Alert” #

After generating the alert, you’ll receive a JSON payload.

Next, follow the link below to learn how to set up your TradingView alert for automated trading:

Setting Up TradingView Alerts for Automated Trading

With everything in place, you’re ready to execute trades by automating TradingView strategies for options in real time.

More Resources on Automating TradingView Alerts #

Want to automate trades on platforms beyond Rithmic, such as Interactive Brokers, TradeLocker, TradeStation, or ProjectX?

Explore all PickMyTrade setup guides

Using Tradovate instead?

View the Tradovate automation guide