1. Indicator JSON Configuration #

This guide explains the JSON Configuration for TradingView Integration with Rithmic using PickMyTrade. By setting up properly structured JSON alerts, you can automate both indicator-based and strategy-based trades with ease.

JSON Breakdown (Indicator) #

{

"symbol": "NQM5",

"date": "{{timenow}}",

"data": "buy",

"quantity": 10,

"risk_percentage": 0,

"price": "{{close}}",

"tp": 0,

"percentage_tp": 100,

"dollar_tp": 0,

"sl": 0,

"dollar_sl": 0,

"percentage_sl": 50,

"order_type": "MKT",

"update_tp": false,

"update_sl": false,

"token": "URe9daf2bc49008ba62dc3",

"duplicate_position_allow": true,

"platform": "RITHMIC",

"reverse_order_close": true,

"multiple_accounts": [

{

"token": "URe9daf2bc49008ba62dc3",

"account_id": "BG28198",

"connection_name": "RITHMIC1",

"risk_percentage": 0,

"quantity_multiplier": 1

}

]

}Explanation of Keys (Indicator) #

| Key | Description |

|---|---|

symbol | The trading asset symbol (e.g., NQM5 for Nasdaq futures). This must match the symbol format required by your broker or trading platform. |

date | The timestamp of when the alert is triggered. The placeholder {{timenow}} dynamically inserts the current time when the alert fires. |

data | Specifies the trade signal generated by the indicator. Examples include: – "buy" (enter a long position),– "sell" (enter a short position). This is a static value set by the indicator’s logic (e.g., a moving average crossover). |

quantity | Defines the number of contracts or shares to trade. A fixed value like 10 indicates 10 units will be traded unless overridden by risk settings. |

risk_percentage | Specifies the percentage of your account balance to risk on the trade. A value of 0 means the trade size is fixed (based on quantity) rather than calculated dynamically from risk. |

price | The execution price of the trade. The placeholder {{close}} dynamically fetches the most recent closing price when the alert triggers. |

tp | Sets a fixed Take Profit (TP) level in price terms. A value of 0 means no fixed TP is applied; TP is determined by other parameters (e.g., percentage_tp). |

percentage_tp | Defines the Take Profit as a percentage of the entry price. A value of 100 means the TP is set at a 100% profit target (e.g., doubling the entry price for a long position). |

dollar_tp | Sets the Take Profit as a fixed dollar amount. Useful for targeting a specific profit in dollar terms. A value of 0 disables this option. |

sl | Sets a fixed Stop Loss (SL) level in price terms. A value of 0 means no fixed SL is applied; SL is determined by other parameters (e.g., percentage_sl). |

dollar_sl | Defines the Stop Loss as a fixed dollar amount. Useful for capping losses at a specific dollar value. A value of 0 disables this option. |

percentage_sl | Sets the Stop Loss as a percentage of the entry price. A value of 50 means the SL triggers at a 50% loss from the entry price. |

order_type | Specifies the type of order to execute. MKT (Market Order) ensures immediate execution at the current market price. |

update_tp | If true, allows the Take Profit level to be dynamically updated for open trades based on new alerts. If false, the TP remains fixed once set. |

update_sl | If true, allows the Stop Loss level to be dynamically updated for open trades based on new alerts. If false, the SL remains fixed once set. |

token | A unique identifier (e.g., URe9daf2bc49008ba62dc3) for authenticating your PickMyTrade account. This ensures secure communication between TradingView and your trading platform. |

duplicate_position_allow | If true, permits multiple trades in the same direction to stack (e.g., adding to a long position with another buy signal). If false, duplicate trades are blocked. |

platform | Specifies the trading platform, in this case RITHMIC, which executes the trades based on the alert. |

reverse_order_close | If true, a reverse order automatically closes an existing position. For example, a "sell" signal will close an open long position before opening a short position. |

multiple_accounts | Allows the alert to send orders to multiple accounts simultaneously. Each entry in this array includes: ➔ token: Matches the main token for account authentication.➔ account_id: Specifies the target account (e.g., BG28198).➔ connection_name: Identifies the specific Rithmic connection (e.g., RITHMIC1).➔ risk_percentage: Sets the risk allocation for this account (e.g., 0 for fixed quantity).➔ quantity_multiplier: Adjusts the trade size for this account (e.g., 1 means the same size as quantity, 2 doubles it). |

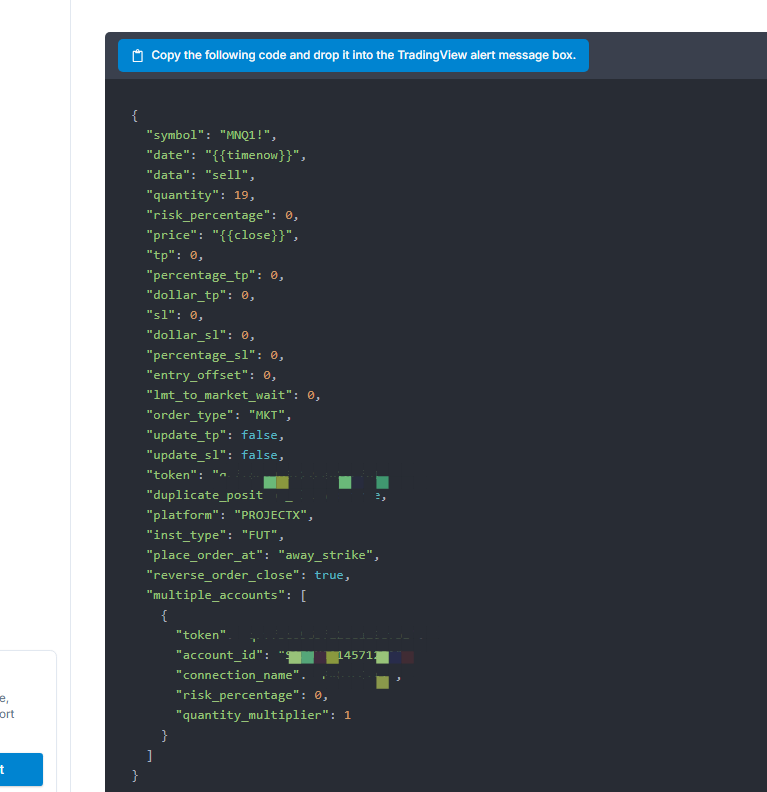

2. Strategy JSON Configuration #

Use this JSON structure to create strategy-based trading alerts. It follows TradingView’s {{strategy.market_position}} logic to determine entry/exit conditions dynamically.

JSON Breakdown (Strategy)

JSON Breakdown (Strategy) #

{

"symbol": "NQM5",

"date": "{{timenow}}",

"data": "{{strategy.market_position}}",

"quantity": "{{strategy.market_position_size}}",

"risk_percentage": 0,

"price": "{{close}}",

"tp": 0,

"percentage_tp": 100,

"dollar_tp": 0,

"sl": 0,

"dollar_sl": 0,

"percentage_sl": 50,

"update_tp": false,

"update_sl": false,

"token": "URe9daf2bc49008ba62dc3",

"duplicate_position_allow": true,

"platform": "RITHMIC",

"order_type": "MKT",

"pyramid": false,

"reverse_order_close": true,

"multiple_accounts": [

{

"token": "URe9daf2bc49008ba62dc3",

"connection_name": "RITHMIC1",

"account_id": "BG28198",

"risk_percentage": 0,

"quantity_multiplier": 1

}

]

}Explanation of Keys (Strategy) #

| Key | Description |

|---|---|

symbol | The trading asset symbol (e.g., NQM5 for Nasdaq futures). This must match the symbol format used by your broker or trading platform. |

date | The timestamp of when the alert is triggered. The placeholder {{timenow}} dynamically inserts the current time when the alert fires. |

data | Specifies the trade signal using TradingView’s {{strategy.market_position}}. This dynamically determines the position type:– long (buy),– short (sell),– flat (close position or no action). |

quantity | Defines the number of contracts or shares to trade, dynamically set by {{strategy.market_position_size}}. This pulls the trade size directly from the TradingView strategy’s position sizing logic. |

risk_percentage | Specifies the percentage of your account balance to risk on the trade. A value of 0 indicates that the trade size is fixed (based on quantity) rather than risk-based. |

price | The execution price of the trade. The placeholder {{close}} dynamically fetches the most recent closing price when the alert triggers. |

tp | Sets a fixed Take Profit (TP) level in price terms. A value of 0 means no fixed TP is applied; TP is determined by other parameters (e.g., percentage_tp). |

percentage_tp | Defines the Take Profit as a percentage of the entry price. A value of 100 means the TP is set at a 100% profit target (e.g., doubling the entry price for a long position). |

dollar_tp | Sets the Take Profit as a fixed dollar amount. Useful for targeting a specific profit in dollar terms. A value of 0 disables this option. |

sl | Sets a fixed Stop Loss (SL) level in price terms. A value of 0 means no fixed SL is applied; SL is determined by other parameters (e.g., percentage_sl). |

dollar_sl | Defines the Stop Loss as a fixed dollar amount. Useful for capping losses at a specific dollar value. A value of 0 disables this option. |

percentage_sl | Sets the Stop Loss as a percentage of the entry price. A value of 50 means the SL triggers at a 50% loss from the entry price. |

order_type | Specifies the type of order to execute. MKT (Market Order) ensures immediate execution at the current market price. |

update_tp | If true, allows the Take Profit level to be dynamically updated for open trades based on new alerts. If false, the TP remains fixed once set. |

update_sl | If true, allows the Stop Loss level to be dynamically updated for open trades based on new alerts. If false, the SL remains fixed once set. |

token | A unique identifier (e.g., URe9daf2bc49008ba62dc3) for authenticating your PickMyTrade account. This ensures secure communication between TradingView and your trading platform. |

duplicate_position_allow | If true, permits multiple trades in the same direction to stack (e.g., adding to a long position). If false, duplicate trades are blocked. |

platform | Specifies the trading platform, in this case RITHMIC, which executes the trades based on the alert. |

order_type | Reiterates the order type (e.g., MKT for Market Order). Ensures clarity in how the trade is placed. |

pyramid | If true, enables pyramiding—stacking additional positions in the same direction as the strategy generates new signals (e.g., increasing a long position). If false, only one position is allowed at a time. |

reverse_order_close | If true, a reverse order automatically closes an existing position. For example, a short signal will close an open long position before opening the new short position. |

multiple_accounts | Allows the alert to send orders to multiple accounts simultaneously. Each entry in this array includes: ➔ token: Matches the main token for account authentication.➔ connection_name: Identifies the specific Rithmic connection (e.g., RITHMIC1).➔ account_id: Specifies the target account (e.g., BG28198).➔ risk_percentage: Sets the risk allocation for this account (e.g., 0 for fixed quantity).➔ quantity_multiplier: Adjusts the trade size for this account (e.g., 1 means the same size as quantity, 2 doubles it). |

More Resources #

Want to automate trades on platforms beyond Rithmic, such as Interactive Brokers, TradeLocker, TradeStation, or ProjectX?

Explore all PickMyTrade setup guides

Using Tradovate instead?

View the Tradovate automation guide