1. Introduction #

Want to automate Interactive Brokers options using TradingView indicators? This guide shows you how to set up alerts and auto-execute trades with PickMyTrade.

- Risk management: Setting stop-loss and take-profit orders to protect your capital.

- Options trading basics: Understanding calls, puts, and strike prices.

- TradingView alerts: Configuring alerts for seamless automated execution with PickMyTrade.

Whether you’re a beginner or an experienced trader, this guide will help you set up automated options trading with Interactive Brokers, leveraging TradingView’s powerful charting tools and PickMyTrade’s automation capabilities. For a visual walkthrough, refer to the PickMyTrade YouTube tutorial or the Interactive Brokers TradingView integration page.

2. Learn Options Trading Essentials #

To automate options trading on Interactive Brokers (IBKR) with TradingView and PickMyTrade, mastering key terms is essential for effective strategies and risk management. Here’s a concise breakdown:

| Term | Explanation |

| Call Option | Right to buy an asset at a strike price before expiration. Ideal for bullish strategies (e.g., expecting AAPL to rise). |

| Put Option | Right to sell an asset at a strike price before expiration. Suits bearish strategies (e.g., expecting TSLA to drop). |

| In-The-Money (ITM) | A Call option is ITM if the stock price is above the strike price. A Put option is ITM if the stock price is below the strike price. |

| Out-Of-The-Money (OTM) | A Call option is OTM if the stock price is below the strike price. A Put option is OTM if the stock price is above the strike price. |

| Strike Price | Price to exercise the option. Key for setting TradingView alerts. |

| Expiration Date | Date the option expires. Automation ensures timely execution. |

| Premium | Cost of the option contract. Optimize entry to lower costs. |

| Lot Size | Shares per contract (typically 100). Impacts position sizing. |

Why It Matters: These terms guide TradingView alert setup (e.g., buying a call when AAPL crosses its strike price) and PickMyTrade risk settings. Practice with IBKR’s paper trading to test strategies.

3. Choose IBKR for Trading #

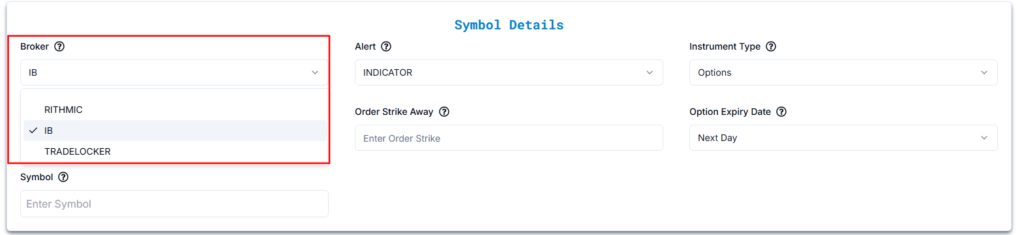

Available Brokers #

Steps #

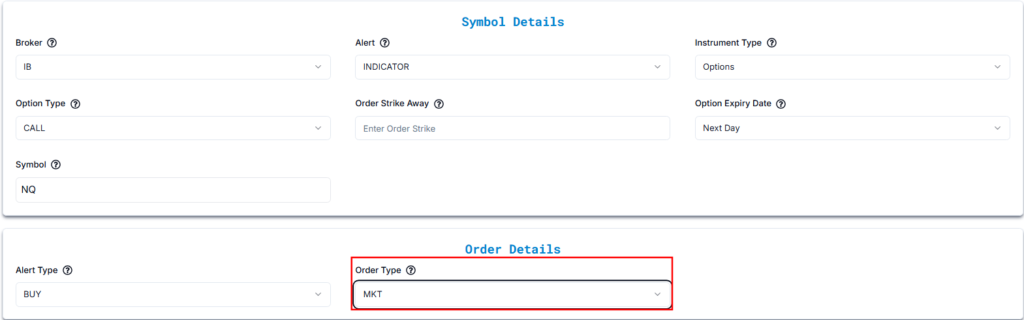

- Select Interactive Brokers (IB) from the available options.

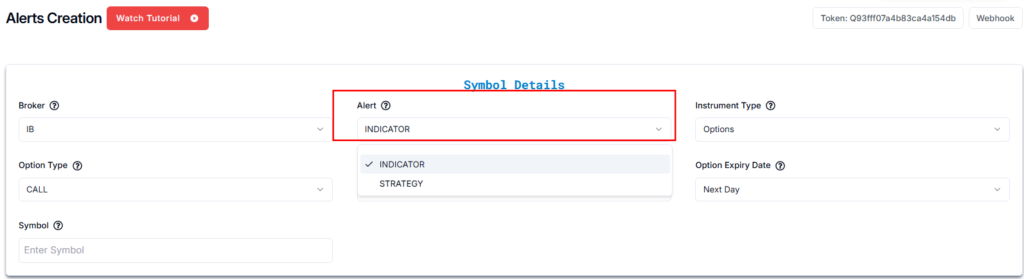

4. Set Up TradingView Automation #

Configure TradingView alerts to trigger automated trades based on technical indicators or strategies. #

| Alert Type | Description |

| INDICATOR | Triggers on indicators (e.g., RSI, Moving Averages). |

| STRATEGY | Triggers on custom TradingView strategies. |

We have selected INDICATOR as our preferred alert type.

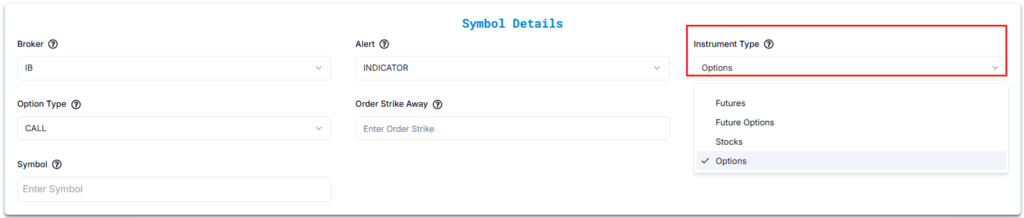

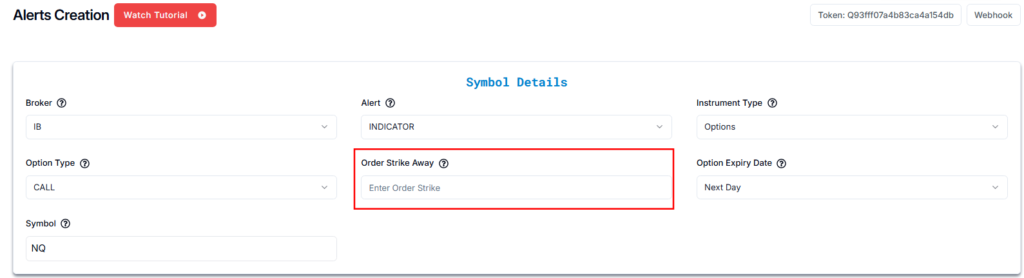

5. Pick Options as Instrument #

Select “Options” from available instruments (Futures, Futures Options, Options, Stocks) in PickMyTrade to focus on options trading.

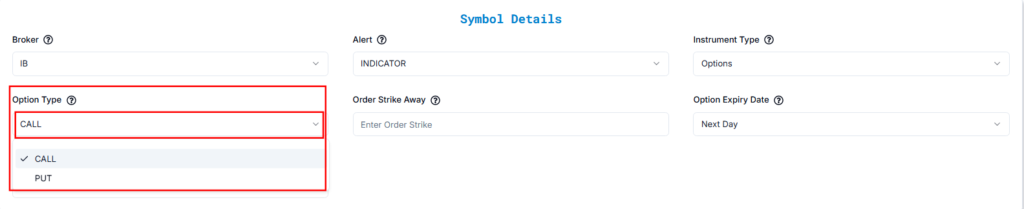

6. Select Call/Put Options #

| Setting | Explanation | Example |

| Call | Expecting the stock price to rise. | Buying an AAPL Call when the stock price is at $150, expecting it to go higher. |

| Put | Expecting the stock price to fall. | Buying a TSLA Put when the stock price is at $700, expecting it to drop. |

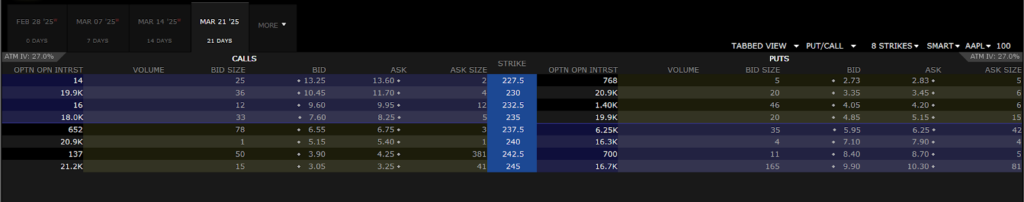

7. Set Strike Price Offset #

| SETTING | EXPLANATION | EXAMPLE |

| Strike Away | Defines how far the strike price is from the market price. | Market price of AAPL: $237.30, Strike Away: 2 → Call strike: $239.30, Put strike: $235.30 |

| At-the-Money (ATM) | Strike price is equal to the market price. | Market price of AAPL: $237.30, Call strike: $237.30, Put strike: $237.30 |

| In-the-Money (ITM) Calls | Strike price is below the market price, making the option immediately valuable. | Market price of AAPL: $237.30, ITM Call strike: $235.30 |

| In-the-Money (ITM) Puts | Strike price is above the market price, making the option immediately valuable. | Market price of AAPL: $237.30, ITM Put strike: $239.30 |

| Out-of-the-Money (OTM) Calls | Strike price is above the market price, meaning the option has no intrinsic value. | Market price of AAPL: $237.30, OTM Call strike: $242.30 |

| Out-of-the-Money (OTM) Puts | Strike price is below the market price, meaning the option has no intrinsic value. | Market price of AAPL: $237.30, OTM Put strike: $232.30 |

Refer to the attached IB screenshot below this table for a visual representation of the option chain and strike prices.

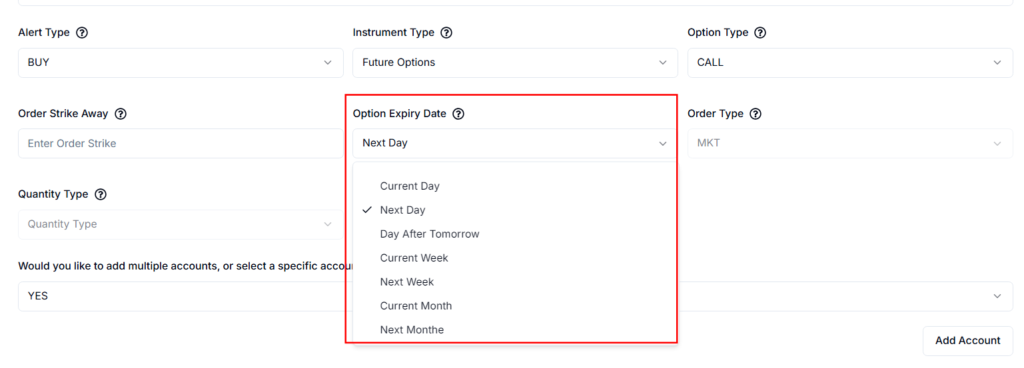

8. Choose Expiry Date #

| Expiry Type | Easy Explanation | Example (AAPL Call Option, Today is March 24, 2025) |

|---|---|---|

| Current Day | Ends today, March 24, 2025. | Buy call option, expires at close of March 24, 2025. |

| Next Day | Ends tomorrow, March 25, 2025. | Buy call option, expires at close of March 25, 2025. |

| Day After Tomorrow | Ends in 2 days, March 26, 2025. | Buy call option, expires at close of March 26, 2025. |

| Current Week | Ends this week, March 28, 2025. | Buy call option, expires at close of March 28, 2025. |

| Next Week | Ends next week, April 4, 2025. | Buy call option, expires at close of April 4, 2025. |

| Current Month | Ends this month, March 31, 2025. | Buy call option, expires at close of March 31, 2025. |

| Next Month | Ends next month, April 30, 2025. | Buy call option, expires at close of April 30, 2025. |

Define Options Contract Symbol

Optional (Only required if Stop Loss type is set to ticks or total loss)

Enter Options Symbol:

This is where you tell PickMyTrade which options contract you want to trade (e.g., AAPL 150C, SPY 400P, etc.). Filling this in is optional but required if you want PickMyTrade to calculate stop loss and take profit based on tick size or total loss.

If the symbol doesn’t exist or isn’t mapped correctly: You’ll need to set it up first in PickMyTrade. Only after this setup will trades occur on that options contract.

Want to send an alert for one options symbol and trade a different one?

You can! For example:

- You’re using AAPL 150C on your TradingView chart for the alert.

- But you want the actual trade to happen on AAPL 155C.

- In this case, just enter AAPL 155C in the PickMyTrade options symbol field.

What if you don’t enter an options symbol here?

No worries — PickMyTrade will simply take the trade based on whatever options chart you’ve set up in TradingView for the alert.

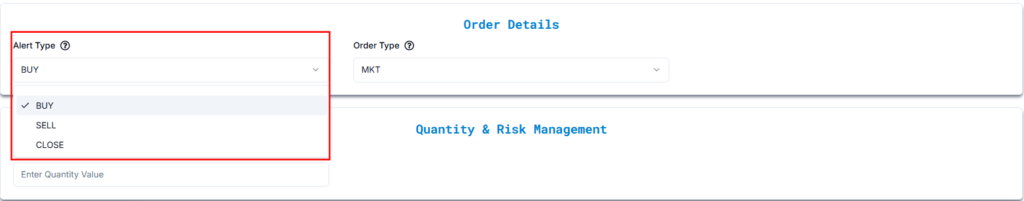

9. Configuring Alert Type #

| Setting | Explanation | Example |

| Buy | Opens a long position when the alert is triggered. | Buying a Call option on AAPL |

| Sell | Opens a short position when the alert is triggered. | Buying a Put option on TSLA |

| Close | Closes an existing position if one exists. | Closing a previously bought Call/Put |

10. Use Market Orders #

Market Order (MKT) for Options in Interactive Brokers (IB) #

Market Order (MKT): Executes at the best available price, prioritizing speed over price control.

Example: Buy an AAPL call at the current market price.

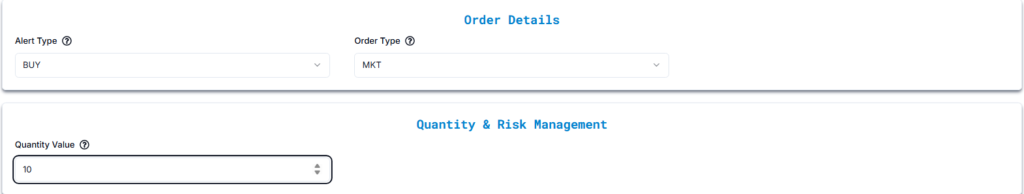

11. Specify Trade Quantity #

Enter the number of contracts you wish to trade.

(Input required: Specify the quantity of contracts.)

We have added: 10

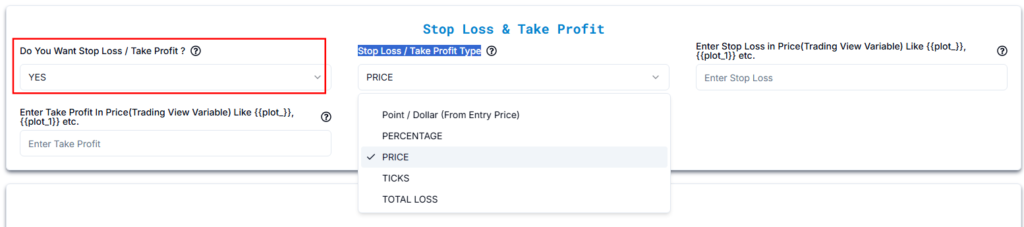

12. Stop Loss / Take Profit #

- “Do You Want Stop Loss / Take Profit?”

Options: YES / NO(Select YES to enable Stop Loss and Take Profit)

13. Stop Loss / Take Profit Type #

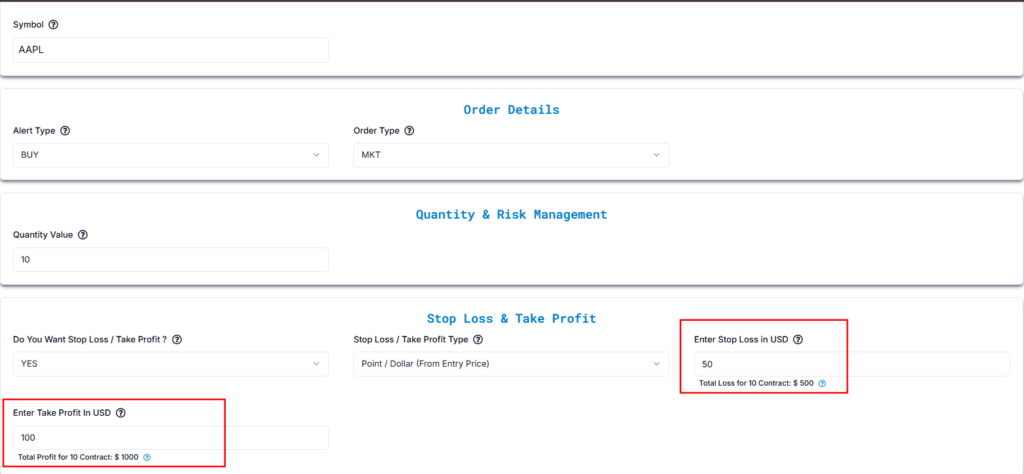

- Point / Dollar (From Entry Price)

Order Configuration:

- Stop Loss in USD: Customer manually inputs the dollar amount they are willing to risk on the trade ( in this example, we’ve chosen $50).

- Take Profit in USD: Customer manually inputs the dollar amount they aim to gain from the trade ( in this example, we’ve chosen $100).

How It Works:

- Stop Loss: The specified USD amount is subtracted from the entry price to determine the stop loss level. The total loss may vary depending on the number of shares.

- Take Profit: The specified USD amount is added to the entry price to determine the take profit level.

Settings and Examples:

Stop Loss (Point / Dollar From Entry Price):

- Setting: Enter the Stop Loss in USD. This amount determines how much you are willing to lose if the market moves against your position.

- Example: Buy AAPL at $239.07 with a Stop Loss at $189.07 ($50.00 below entry). Total loss: $50.00 × 1 (lot size) × 10 (number of shares) = $500.

Take Profit (Point / Dollar From Entry Price):

- Setting: Enter the Take Profit in USD. This amount sets your target gain if the market moves in your favor.

- Example: Buy AAPL at $239.07 with a Take Profit at $339.07 ($100.00 above entry). Total profit: $100.00 × 1 (lot size) × 10 (number of shares) = $1,000.

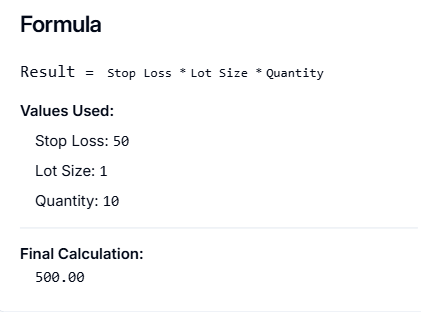

Calculation Details #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula used

- The Values Entered by the user

- The Final Calculation result

Result Calculation:

Stop Loss Calculation:

- Formula: Stop Loss × Lot Size × Quantity

- Values Used:

- Stop Loss: $50

- Lot Size: 1

- Quantity: 10

Final Calculation: $50 × 1 × 10 = $500

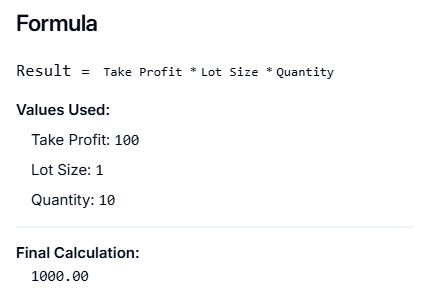

Take Profit Calculation:

- Formula: Take Profit × Lot Size × Quantity

- Values Used:

- Take Profit: $100

- Lot Size: 1

- Quantity: 10

- Final Calculation: $100 × 1 × 10 = $1,000

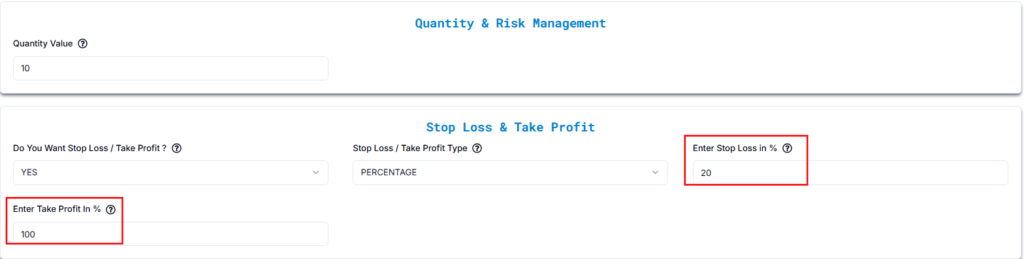

- Percentage

Order Configuration:

- Stop Loss in %: Customer manually inputs the percentage they are willing to risk on the trade (in this example, we’ve chosen 20%).

- Take Profit in %: Customer manually inputs the percentage they aim to gain from the trade (in this example, we’ve chosen 100%).

How It Works:

- Stop Loss: The specified percentage is calculated based on the entry price and subtracted to determine the stop loss level. The total loss varies depending on the entry price and lot size.

- Take Profit: The specified percentage is calculated based on the entry price and added to determine the take profit level.

Settings and Examples:

Stop Loss (Percentage):

- Setting: Enter the Stop Loss as a percentage of the entry price. If the market price falls by this percentage, the trade automatically closes to limit your loss.

- Example: Buy AAPL at $239.07 (Entry Price)

- Stop Loss: 20% below entry price

- 20% of $239.07 = $239.07 × 0.20 = $47.81

- Stop Loss Price = $239.07 − $47.81 = $191.26

Take Profit (Percentage):

- Setting: Enter the Take Profit as a percentage of the entry price. If the market price rises by this percentage, the trade automatically closes to secure your profit.

- Example: Buy AAPL at $239.07 (Entry Price)

- Take Profit: 100% above entry price

- 100% of $239.07 = $239.07 × 1.00 = $239.07

- Take Profit Price = $239.07 + $239.07 = $478.14

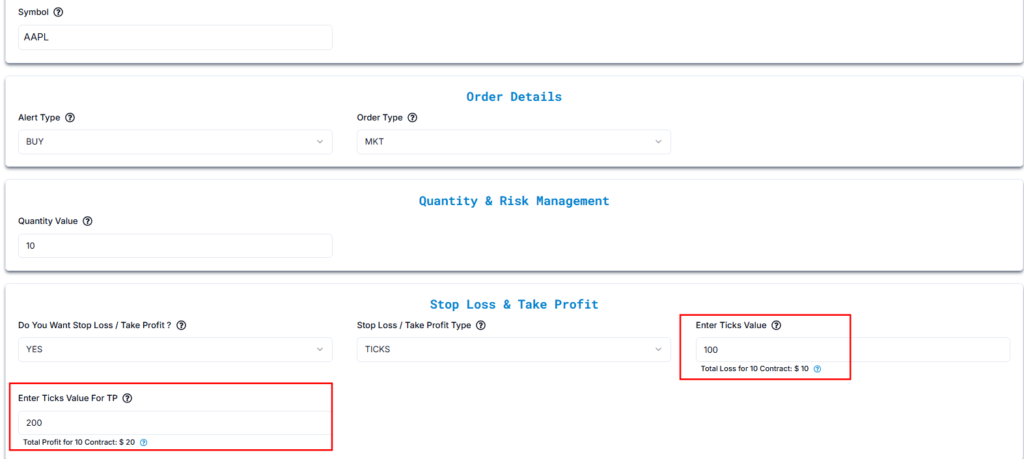

- Ticks

- AAPL Market Price: $239.07

- Tick Size: $0.01 (since AAPL trades in cents)

- Quantity: 10 contracts (I’m assuming each contract represents 1 share of AAPL — let me know if that’s different!)

Now for the Stop Loss & Take Profit:

- Stop Loss:

- Ticks: 100

- Tick Size: $0.01

- 100 ticks × $0.01 = $1.00

- Stop Loss Price: $239.07 − $1.00 = $238.07

- Total Loss Calculation:

- Loss per Tick: $0.01

- Quantity: 10 contracts

- Total Loss: 100 ticks × $0.01 × 10 = $10.00

- Take Profit:

- Ticks: 200

- Tick Size: $0.01

- 200 ticks × $0.01 = $2.00

- Take Profit Price: $239.07 + $2.00 = $241.07

- Total Profit Calculation:

- Profit per Tick: $0.01

- Quantity: 10 contracts

- Total Profit: 200 ticks × $0.01 × 10 = $20.00

So your numbers actually make total sense!

- Total Loss for 10 Contracts: $10.00

- Total Profit for 10 Contracts:$20.00

Calculation Details

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula used

- The Values Entered by the user

- The Final Calculation result

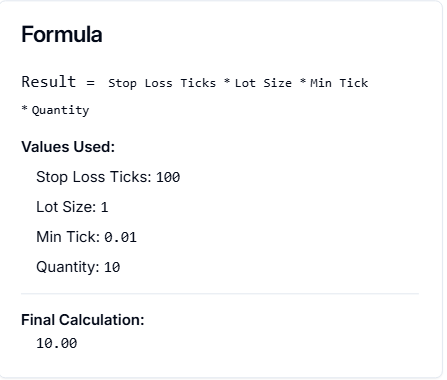

Formula for Stop Loss:

Stop Loss Amount = Stop Loss Ticks × Lot Size × Min Tick × Quantity

Values:

Stop Loss Ticks: 100

Lot Size: 1

Min Tick: 0.01

Quantity: 10

Final Calculation:

Stop Loss Amount = 100 × 1 × 0.01 × 10 = 10.00

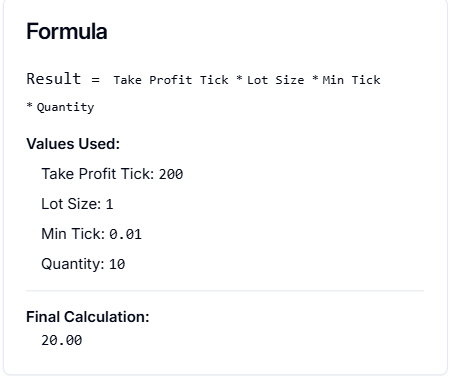

Formula for Take Profit:

Take Profit Amount = Take Profit Ticks × Lot Size × Min Tick × Quantity

Values:

Take Profit Ticks: 200

Lot Size: 1

Min Tick: 0.01

Quantity: 10

Final Calculation:

Take Profit Amount = 200 × 1 × 0.01 × 10 = 20.00

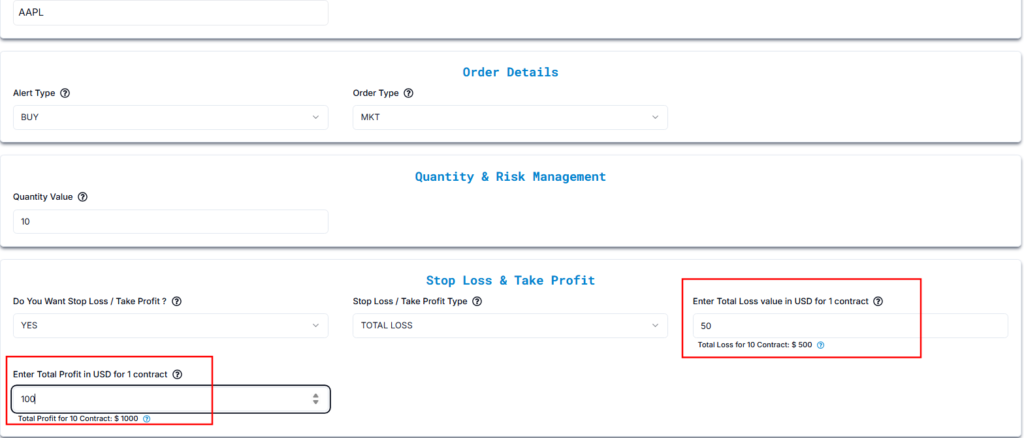

- Total Profit / Loss

Order Configuration:

- Total Loss per Contract: The total dollar amount of loss you’re willing to take per contract.

- Total Profit per Contract: The total dollar amount of profit you’re aiming for per contract.

AAPL Market Price: $239.07

Lot Size: 1 (1 contract = 1 share)

Quantity: 10 contracts

Total Loss (USD per Contract):

- Example: Let’s say you’re willing to lose $50 per contract.

- Total Contracts: 10

- Total Loss for 10 Contracts: $50 × 10 = $500

- Stop Loss Price Calculation:

- AAPL moves in $0.01 increments (min tick).

- $50 per contract ÷ $0.01 tick size = 5,000 ticks.

- Stop Loss Price: $239.07 − ($0.01 × 5,000) = $189.07

Total Profit (USD per Contract):

- Example: Let’s say you’re targeting $100 per contract.

- Total Contracts: 10

- Total Profit for 10 Contracts: $100 × 10 = $1,000

- Take Profit Price Calculation:

- $100 per contract ÷ $0.01 tick size = 10,000 ticks.

- Take Profit Price: $239.07 + ($0.01 × 10,000) = $339.07

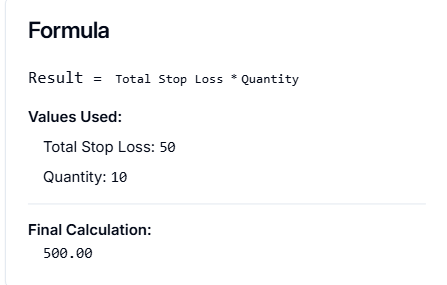

Formula for Total Take Profit:

Total Profit Amount = Total Profit per Contract × Quantity

Values:

Total Profit per Contract: $100

Quantity: 10

Final Calculation:

Total Profit Amount = $100 × 10 = $1,000.00

Formula for Total Take Profit:

Total Profit Amount = Total Take Profit per Contract × Quantity

Values:

Total Take Profit per Contract: $100

Quantity: 10

Final Calculation:

Total Profit Amount = $100 × 10 = $1,000.00

14. Select IBKR Account: #

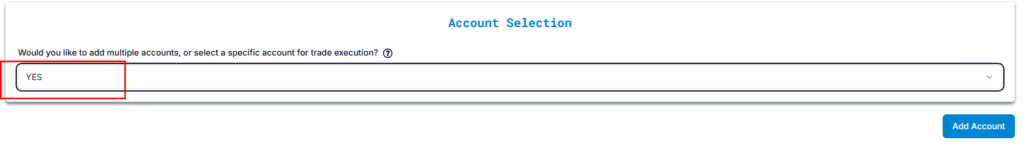

Would you like to add multiple accounts or select a specific account for trade execution?

Answer:YES (Upon selecting YES, additional configuration options become available.)

or trade execution?

Yes – You can configure multiple accounts or execute trades from a specific account in Interactive Brokers (IB).

A. Add an IB Subaccount Under an Existing PickMyTrade Login #

If you have multiple IB accounts linked under a single IB login, you can allocate trades to them using quantity multipliers.

- PickMyTrade Connection Name: Choose the IB account where you want to execute trades.

- Quantity Multiplier: Adjusts the number of contracts proportionally for each account.

Example: #

If you have two IB subaccounts:

- IB_Account_1 (Primary) → Multiplier: 1.5 (Executes 1.5 times the default contract size)

- IB_Account_2 (Secondary) → Multiplier: 1.0 (Executes the standard contract size)

This setup ensures proportional trade execution across multiple subaccounts.

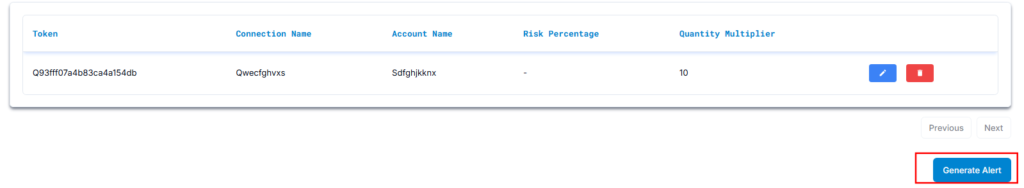

B. Add a Separate IB Account Under Another PickMyTrade Login #

For traders managing multiple IB accounts under different PickMyTrade logins, you can link each account individually using a unique authentication token.

- PickMyTrade Token: Enter the token associated with the IB account you want to add.

- PickMyTrade Connection Name: Enter the exact connection name as displayed in your PickMyTrade account.

- Quantity Multiplier: Defines how much the contract size should be adjusted for this account.

Example: #

If you have two separate IB accounts under different PickMyTrade logins:

- IB_Account_3 (Second IB Account) → Multiplier: 2.0

- IB_Account_4 (Primary IB Account) → Multiplier: 1.5

In this scenario, trades in the second IB account execute at 2x the default size, while the primary account follows a 1.5x multip

Once these values are entered, click “Generate Alert” to proceed.

Create PickMyTrade Alert #

Click “Generate Alert” in PickMyTrade to create a JSON payload for TradingView.

Next: Set up the alert in TradingView (guide). #

Setting Up TradingView Alerts for Automated Trading

15. Decode JSON Alert Settings: #

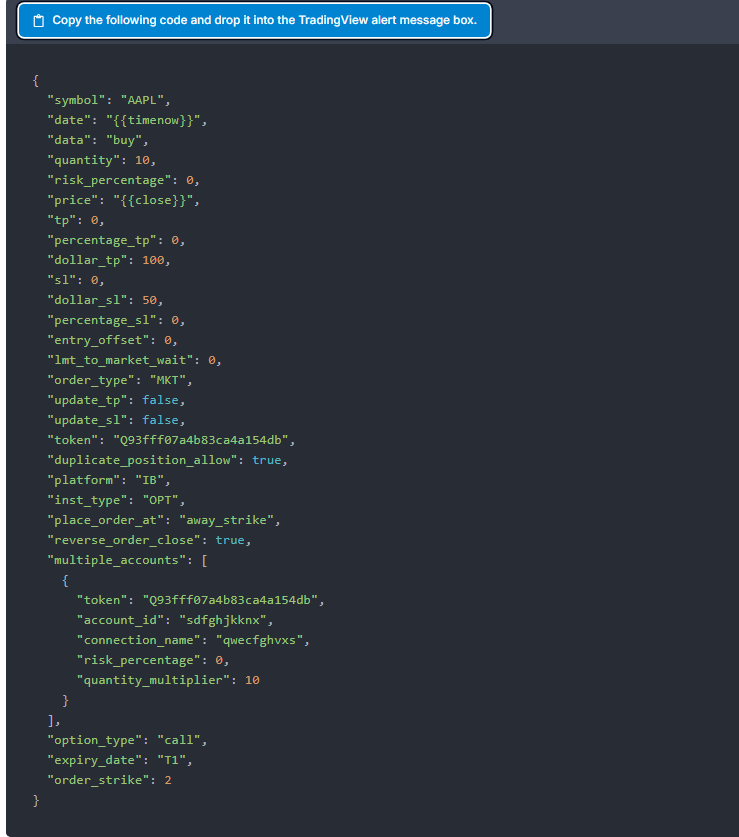

The alert will be generated in JSON format like this:

Parameter Breakdown #

- symbol – Defines the trading instrument. In this case,

"AAPL"represents Apple stock options. - date – The timestamp when the order is executed, dynamically generated using

"{{timenow}}". - data – Specifies the trade action:

"buy"– Executes a buy order."sell"– Executes a sell order."close"– Closes an open position.

- quantity – Specifies the number of contracts or shares to be traded. Here, it is set to

10. - risk_percentage – If greater than

0, the system calculates the trade size based on the account balance and stop loss. Here, it is set to0, meaning the quantity is manually defined. - price – The execution price. If not specified, it defaults to the latest closing price using

"{{close}}". - Take Profit (TP) settings:

- tp – A fixed take profit price (set to

0, meaning not used). - percentage_tp – Defines the take profit as a percentage of the entry price (set to

0). - dollar_tp – Specifies the take profit level in dollar value (

100dollars).

- tp – A fixed take profit price (set to

- Stop Loss (SL) settings:

- sl – A fixed stop loss price (set to

0, meaning not used). - percentage_sl – Sets the stop loss as a percentage of the entry price (

0). - dollar_sl – Specifies stop loss in dollar terms (

50dollars).

- sl – A fixed stop loss price (set to

- entry_offset – Adjusts order execution by a specified offset (set to

0). - lmt_to_market_wait – If using a limit order, this sets the wait time before converting it to a market order (set to

0). - order_type – Defines the type of order execution:

"MKT"– Market Order (executes at the best available price).

- update_tp – If

false, a new take profit order is created instead of modifying an existing one. - update_sl – If

false, a new stop loss order is created instead of modifying an existing one. - token – The API authentication token that allows TradingView to communicate with the brokerage platform.

- duplicate_position_allow – If

true, multiple open positions in the same symbol are allowed. - platform – Specifies the brokerage platform used for trading:

"IB"– Interactive Brokers.

- inst_type – Defines the instrument type:

"OPT"– Options trading.

- place_order_at – Specifies how the order should be placed:

"away_strike"– Indicates that the order should be placed at a different strike price.

- reverse_order_close – If

true, the system closes any opposite position before placing a new order. - multiple_accounts – This section allows executing trades across multiple accounts:

- token – The API token for the specific account.

- account_id – Unique identifier for the trading account (

"sdfghjkknx"). - connection_name – Name assigned to the connection (

"qwecfghvxs"). - risk_percentage – Defines the percentage of the account balance allocated for the trade (

0). - quantity_multiplier – Adjusts trade size by multiplying the base quantity. Here, it is set to

10, meaning the order size is multiplied by10for this account.

- option_type – Specifies the type of options contract:

"call"– Call option.

- expiry_date – Defines the expiry type of the options contract:

"T1"– This represents the expiry type (e.g., Next Day expiry).

- order_strike – Defines the strike price offset (

2), meaning the order will be placed at a strike price two levels away from the current market price.

16. Fix PickMyTrade Problems #

- Connection Issues? Ensure your IB account is active and reconnects.

- Need Help? Contact PickMyTrade support

Email: [email protected]

Discord Community: Join & Connect