1. Introduction to Options & Futures Options Automation in IB #

This guide walks you through TradingView Interactive Brokers automation for options and futures trading. You’ll learn how to configure alerts, symbols, SL/TP rules, and multi-account execution using PickMyTrade.

For a visual walkthrough, refer to the accompanying video:

What This Guide Covers #

- Core options terminology

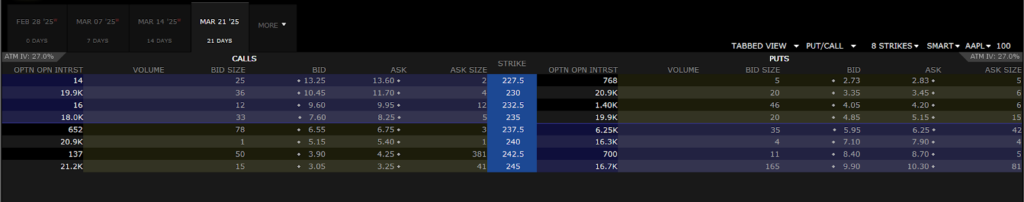

- Strike price selection with visual examples

- How PickMyTrade executes options orders

- Options Greeks for advanced traders

- Risk warnings and best practices

How Options Automation Works #

- TradingView sends an options alert

- PickMyTrade parses symbol, strike, and direction

- Risk and quantity rules are applied

- Order is routed to Interactive Brokers

- IB executes the option trade

2. Understanding Options Trading Basics #

Before setting up automated trading, it’s crucial to understand key terms:

| Term | Explanation |

| Call Option | Gives the buyer the right (but not the obligation) to buy an asset at a specified price before expiration. Ideal when expecting the asset price to rise. |

| Put Option | Gives the buyer the right (but not the obligation) to sell an asset at a specified price before expiration. Ideal when expecting the asset price to drop. |

| In-The-Money (ITM) | A Call option is ITM if the stock price is above the strike price. A Put option is ITM if the stock price is below the strike price. |

| Out-Of-The-Money (OTM) | A Call option is OTM if the stock price is below the strike price. A Put option is OTM if the stock price is above the strike price. |

| Strike Price | The price at which the option can be exercised. |

| Expiration Date | The date by which the option contract expires. |

| Premium | The cost to purchase an option contract. |

| Lot Size | The number of shares per contract (typically 100 per contract). |

3. Interactive Brokers Setup for TradingView Automation #

Available Brokers #

Steps #

- Select Interactive Brokers (IB) from the available options.

4. Configuring Alerts in TradingView #

Alert Type Options #

| Alert Type | Description |

| INDICATOR | Alerts based on technical indicators (e.g., RSI, Moving Averages). |

| STRATEGY | Alerts based on predefined trading strategies in TradingView. |

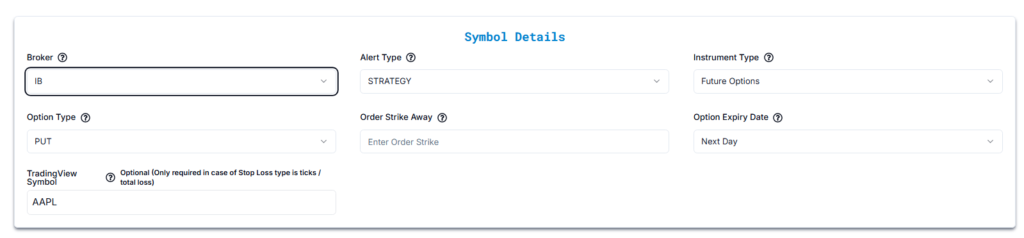

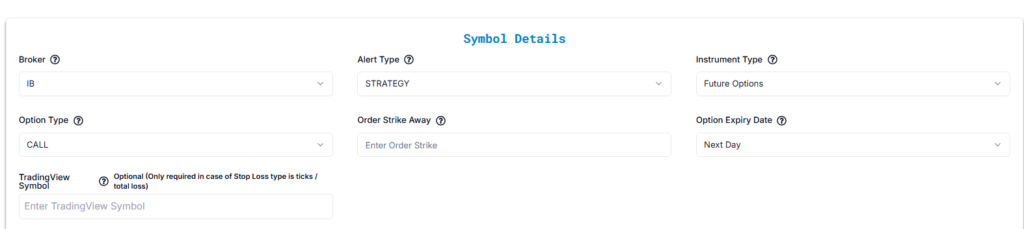

We have selected STRATEGY as our preferred alert type.

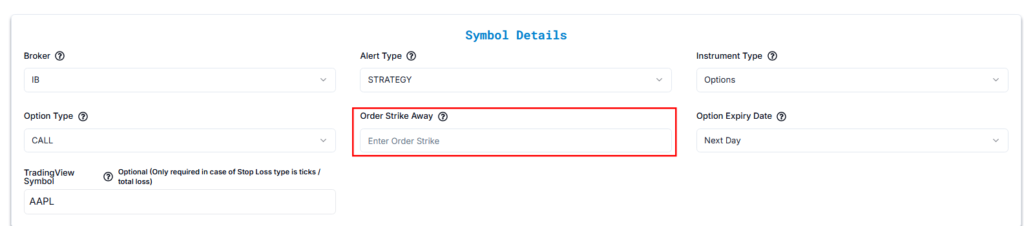

5. Selecting the Correct Instrument Type for IB Execution #

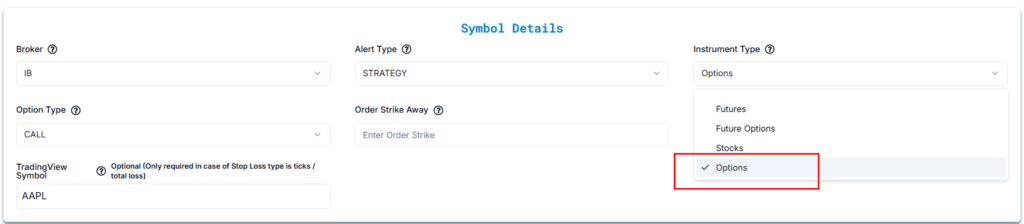

Choose Options from the available choices: Futures, Futures Options, Options, Stocks.

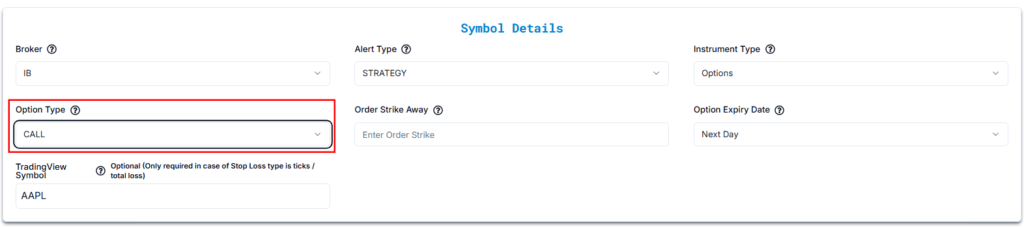

6. Defining Option Type: Call or Put #

| Setting | Explanation | Example |

| Call | Expecting the stock price to rise. | Buying an AAPL Call when the stock price is at $150, expecting it to go higher. |

| Put | Expecting the stock price to fall. | Buying a TSLA Put when the stock price is at $700, expecting it to drop. |

7. Configuring Strike Price: ATM, ITM, OTM, Strike Away #

| SETTING | EXPLANATION | EXAMPLE |

| Strike Away | Defines how far the strike price is from the market price. | Market price of AAPL: $237.30, Strike Away: 2 → Call strike: $239.30, Put strike: $235.30 |

| At-the-Money (ATM) | Strike price is equal to the market price. | Market price of AAPL: $237.30, Call strike: $237.30, Put strike: $237.30 |

| In-the-Money (ITM) Calls | Strike price is below the market price, making the option immediately valuable. | Market price of AAPL: $237.30, ITM Call strike: $235.30 |

| In-the-Money (ITM) Puts | Strike price is above the market price, making the option immediately valuable. | Market price of AAPL: $237.30, ITM Put strike: $239.30 |

| Out-of-the-Money (OTM) Calls | Strike price is above the market price, meaning the option has no intrinsic value. | Market price of AAPL: $237.30, OTM Call strike: $242.30 |

| Out-of-the-Money (OTM) Puts | Strike price is below the market price, meaning the option has no intrinsic value. | Market price of AAPL: $237.30, OTM Put strike: $232.30 |

Refer to the attached IB screenshot below this table for a visual representation of the option chain and strike prices.

How to Choose #

- ITM: Safer, higher cost, lower leverage

- ATM: Most popular for directional trades

- OTM: High leverage, lower win rate

8. Adding TradingView Symbol for Accurate Mapping #

Optional (Only required if Stop Loss type is set to ticks or total loss)

Enter Options Symbol:

This is where you tell PickMyTrade which options contract you want to trade (e.g., AAPL 150C, SPY 400P, etc.). Filling this in is optional but required if you want PickMyTrade to calculate stop loss and take profit based on tick size or total loss.

If the symbol doesn’t exist or isn’t mapped correctly: You’ll need to set it up first in PickMyTrade. Only after this setup will trades occur on that options contract.

Want to send an alert for one options symbol and trade a different one?

You can! For example:

- You’re using AAPL 150C on your TradingView chart for the alert.

- But you want the actual trade to happen on AAPL 155C.

- In this case, just enter AAPL 155C in the PickMyTrade options symbol field.

What if you don’t enter an options symbol here?

No worries — PickMyTrade will simply take the trade based on whatever options chart you’ve set up in TradingView for the alert.

9. Managing Strategy Exits from TradingView #

Confirm Exit Handling

Determine how exits will be managed for your strategy:

Multiple Exits (e.g., TP1, TP2): #

Yes: If your strategy has multiple exit levels (e.g., TP1, TP2), IB will not prompt for additional Stop Loss (SL) or Take Profit (TP) settings.

- Automated Exits: Exits can be fully automated within the TradingView strategy.

- Attaching SL/TP to Entry Orders: If you opt to attach Stop Loss and Take Profit to entry orders in IB, only one TP and one SL per order are supported. Multiple exit levels (e.g., TP1, TP2) are not accommodated in this configuration.

No: If your strategy does not handle exits, you must manually configure Stop Loss (SL) and Take Profit (TP) settings in IB.

Would your strategy have multiple exits like TP1, TP2, etc.?

No

→ Would you like to place Stop Loss and Take Profit orders in IB with each order from your strategy?

Yes

→ Stop Loss / Take Profit / BreakEven Type:

(Refer to the table in the “Select TradingView Indicator” section for a detailed explanation of each option.) Click here.

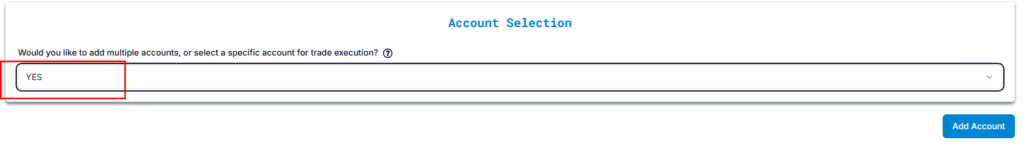

10. Selecting and Configuring Your Interactive Brokers Account #

Would you like to add multiple accounts or select a specific account for trade execution?

Answer:YES (Upon selecting YES, additional configuration options become available.)

or trade execution?

Yes – You can configure multiple accounts or execute trades from a specific account in Interactive Brokers (IB).

A. Add an IB Subaccount Under an Existing PickMyTrade Login #

If you have multiple IB accounts linked under a single IB login, you can allocate trades to them using quantity multipliers.

- PickMyTrade Connection Name: Choose the IB account where you want to execute trades.

- Quantity Multiplier: Adjusts the number of contracts proportionally for each account.

Example: #

If you have two IB subaccounts:

- IB_Account_1 (Primary) → Multiplier: 1.5 (Executes 1.5 times the default contract size)

- IB_Account_2 (Secondary) → Multiplier: 1.0 (Executes the standard contract size)

This setup ensures proportional trade execution across multiple subaccounts.

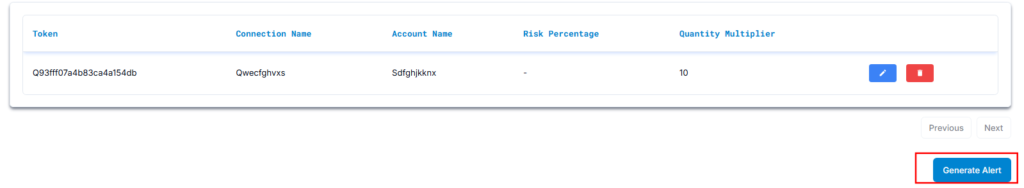

B. Add a Separate IB Account Under Another PickMyTrade Login #

For traders managing multiple IB accounts under different PickMyTrade logins, you can link each account individually using a unique authentication token.

- PickMyTrade Token: Enter the token associated with the IB account you want to add.

- PickMyTrade Connection Name: Enter the exact connection name as displayed in your PickMyTrade account.

- Quantity Multiplier: Defines how much the contract size should be adjusted for this account.

Example: #

If you have two separate IB accounts under different PickMyTrade logins:

- IB_Account_3 (Second IB Account) → Multiplier: 2.0

- IB_Account_4 (Primary IB Account) → Multiplier: 1.5

In this scenario, trades in the second IB account execute at 2x the default size, while the primary account follows a 1.5x multip

Once these values are entered, click “Generate Alert” to proceed.

Creating and Sending Alerts from TradingView #

Click on “Generate Alert” #

After generating the alert, you’ll receive a JSON payload.

Next, follow the link below to learn how to set up your TradingView alert for automated trading:

Setting Up TradingView Alerts for Automated Trading

11. JSON Alert Structure Explained #

The alert will be generated in JSON format like this:

Parameter Breakdown #

{

"symbol": "AAPL",

"date": "{{timenow}}",

"data": "buy",

"quantity": 10,

"risk_percentage": 0,

"price": "{{close}}",

"tp": 0,

"percentage_tp": 100,

"dollar_tp": 100,

"sl": 0,

"percentage_sl": 50,

"dollar_sl": 50,

"entry_offset": 0,

"lmt_to_market_wait": 0,

"order_type": "MKT",

"update_tp": false,

"update_sl": false,

"token": "<YOUR_API_TOKEN>",

"duplicate_position_allow": false,

"platform": "IB",

"inst_type": "OPT",

"place_order_at": "away_strike",

"reverse_order_close": false,

"multiple_accounts": [

{

"token": "<YOUR_ACCOUNT_API_TOKEN>",

"account_id": "sdfghjkknx",

"connection_name": "qwecfghvxs",

"risk_percentage": 0,

"quantity_multiplier": 10

}

],

"option_type": "call",

"expiry_date": "T1",

"order_strike": 237.30

}

Symbol

- Trading instrument (e.g.,

'AAPL'for Apple stock options).

Date

- Automatically inserts the current timestamp.

Data

- Defines the trade action:

'buy','sell', or'close'.

Quantity

- Number of contracts/shares to trade (e.g.,

10contracts).

Risk Percentage

0= manual quantity entry.- Greater than

0= trade size calculated based on account balance and stop loss.

Price

- Uses the latest closing price if not specified.

Take Profit (TP) Settings #

TP

- Fixed take profit price (not used).

Percentage TP

- Sets take profit at

100%above entry price.

Dollar TP

- Sets take profit at a

$100gain.

Stop Loss (SL) Settings #

SL

- Fixed stop loss price (not used).

Percentage SL

- Sets stop loss at

50%below entry price.

Dollar SL

- Sets stop loss at a

$50loss.

Order Settings #

Entry Offset

- Adjusts order execution by an offset (not used).

LMT to Market Wait

- Time delay before converting a limit order to a market order (not used).

Order Type

'MKT'for immediate market order execution.

Update TP/SL

False= new TP/SL orders are created instead of modifying existing ones.

Token

- API token for secure communication.

Duplicate Position Allow

False= prevents multiple open positions on the same symbol.

Platform & Account Details #

Platform

'IB'for Interactive Brokers.

Inst Type

'OPT'indicates options trading.

Place Order At

- Places order at a specified strike price offset.

Reverse Order Close

False= prevents closing opposite positions before placing new orders.

Multiple Accounts #

Each entry under multiple_accounts manages additional accounts with specific settings.

Quantity Multiplier

- Multiplies the base quantity (e.g.,

10xbase order size).

Options Contract Details #

Option Type

- Specifies a

'call'option contract.

Expiry Date

'T1'sets options expiry to ‘Next Day’.

Order Strike

- Sets the strike price for the order.

16. Options Risk Warning #

Options trading involves significant risk of loss. Key considerations:

- Time Decay (Theta)

Option value decreases every day, even if price doesn’t move. - Premium Loss

If an option expires OTM, 100% of the premium can be lost. - Complex Pricing

Direction alone does not guarantee profit.

Recommendation #

Always test options strategies in an Interactive Brokers paper account before deploying live capital.

17. Best Practices for Automated Options Trading #

- Prefer ATM or ITM strikes for automation

- Avoid illiquid contracts

- Use defined-risk sizing

- Trade liquid underlyings (SPY, QQQ, AAPL, TSLA)

- Monitor expiration dates closely

18. Summary #

Automating options with PickMyTrade allows TradingView strategies to execute seamlessly on Interactive Brokers. Success depends on:

- Proper strike selection

- Understanding option behavior

- Conservative risk management

- Thorough paper testing

19. Troubleshooting and FAQs #

- Connection Issues? Ensure your IB account is active and reconnects.

- Need Help? Contact PickMyTrade support

Email: [email protected]

Discord Community: Join & Connect