1. Introduction #

Automating TradingView indicator alerts for options in TradeStation allows traders to execute real-time options trades directly from chart-based signals. This guide shows you how to configure it step-by-step using PickMyTrade.

Watch the video above for a quick walkthrough on setting up automated options trading from TradingView to TradeStation using PickMyTrade.

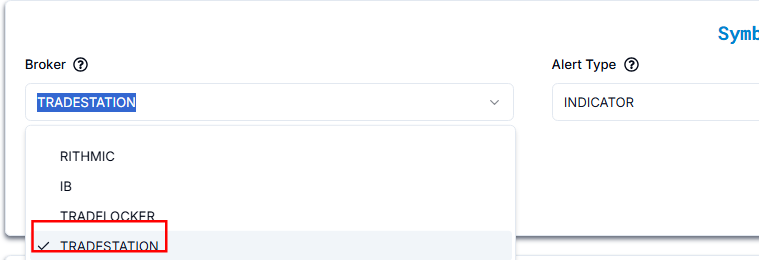

2. Select TradeStation as Your Broker #

- Broker: Select TradeStation from the PickMyTrade broker list.

- Ensure your TradeStation account is connected and authorized via secure login or API credentials.

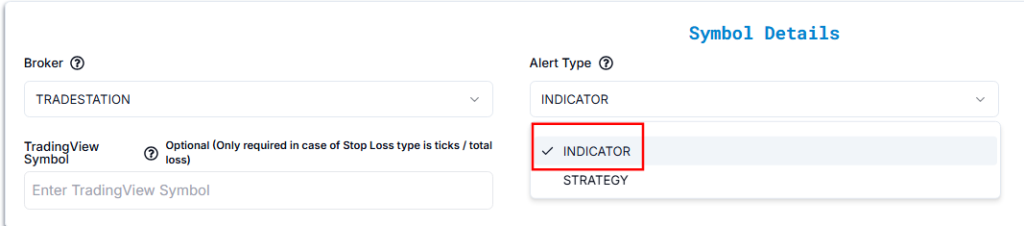

3. Choose Strategy or Indicator Alert in TradingView #

Alert Type Options # #

| Alert Type | Description |

| INDICATOR | Alerts based on technical indicators (e.g., RSI, Moving Averages). |

| STRATEGY | Alerts based on predefined trading strategies in TradingView. |

We have selected INDICATOR as our preferred alert type.

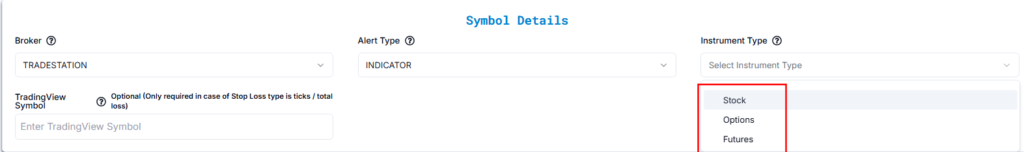

4. Choose Asset Type for TradeStation Execution #

Select the appropriate instrument type based on what you’re trading:

- Stocks – For equity shares like AAPL, MSFT, etc.

- Futures – For standard futures contracts like MNQ, ES, etc.

- Options – For equity options like AAPL Calls and Puts.

In this setup, we are selecting Options because we are automating trades for AAPL options.

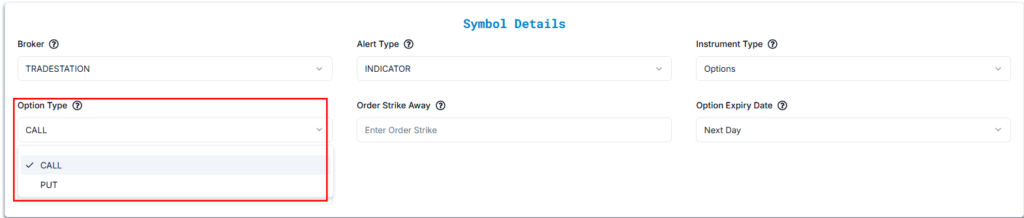

5. Select Call or Put Option Type for TradeStation Orders #

| Setting | Explanation | Example |

| Call | Expecting the stock price to rise. | Buying an AAPL Call when the stock price is at $150, expecting it to go higher. |

| Put | Expecting the stock price to fall. | Buying a TSLA Put when the stock price is at $700, expecting it to drop. |

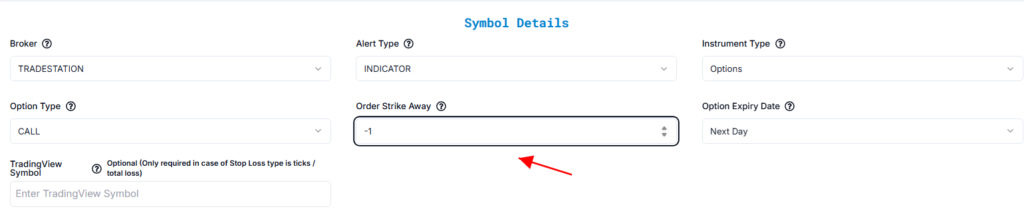

6. Set Strike Price Logic for Option Alerts in TradingView #

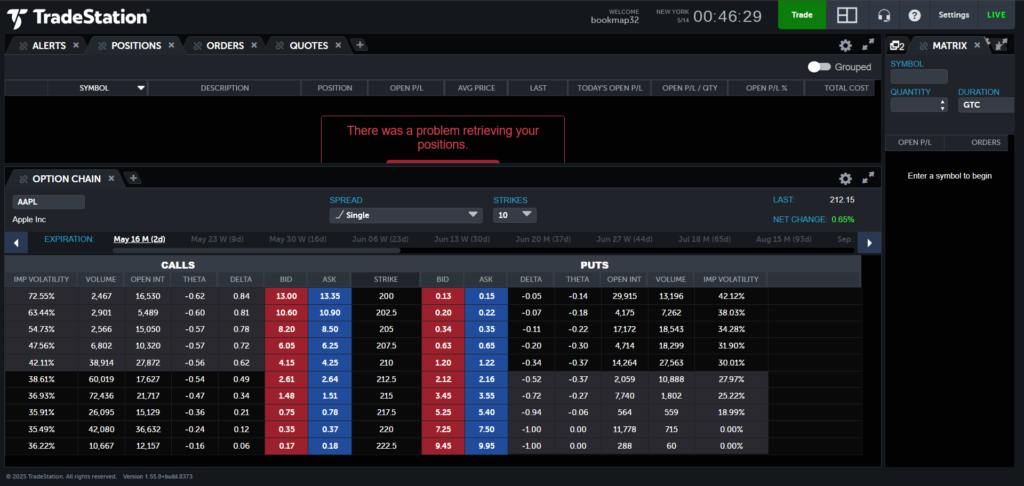

Strike Price Settings (Updated for AAPL @ $212.15) #

| SETTING | EXPLANATION | EXAMPLE (AAPL @ $212.15) |

|---|---|---|

| Strike Away | Defines how far the strike is from the market price. | Strike Away: 2 → Call strike: 214.15, Put strike: 210.15 |

| At-the-Money (ATM) | Strike price is closest to the market price. | Call & Put strike: 212.5 |

| In-the-Money (ITM) Calls | Strike below the market price (option has intrinsic value). | ITM Call strikes: 210, 207.5, 205… |

| In-the-Money (ITM) Puts | Strike above the market price (option has intrinsic value). | ITM Put strikes: 215, 217.5, 220… |

| Out-of-the-Money (OTM) Calls | Strike above the market price (no intrinsic value). | OTM Call strikes: 215, 217.5, 220… |

| Out-of-the-Money (OTM) Puts | Strike below the market price (no intrinsic value). | OTM Put strikes: 210, 207.5, 205… |

Visual Reference (from screenshot):

- AAPL Last Price: 212.15

- Closest strike: 212.5

- Call Bid/Ask at 212.5: 2.61 / 2.64

- Put Bid/Ask at 212.5: 2.13 / 2.16

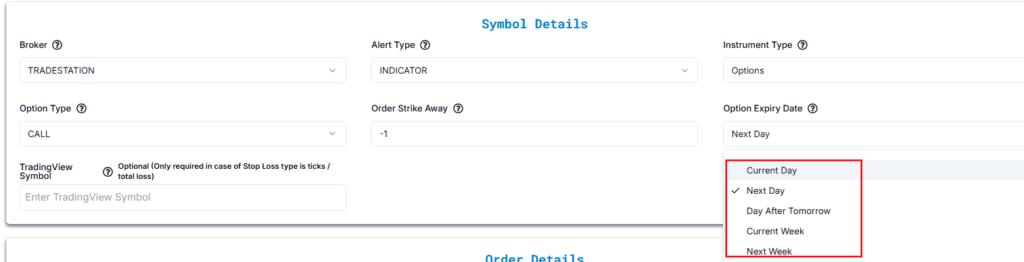

7. Configure Option Expiry Dates for AAPL Options in TradeStation #

Select relative expiry using the current date for reference (e.g., May 14, 2025):

| Expiry Type | Easy Explanation | Example (AAPL Call Option, Today is May 14, 2025) |

|---|---|---|

| Current Day | Ends today, May 14, 2025. | Buy call option, expires at close of May 14, 2025. |

| Next Day | Ends tomorrow, May 15, 2025. | Buy call option, expires at close of May 15, 2025. |

| Day After Tomorrow | Ends in 2 days, May 16, 2025. | Buy call option, expires at close of May 16, 2025. |

| Current Week | Ends this week, May 16, 2025. | Buy call option, expires at close of May 16, 2025. |

| Next Week | Ends next week, May 23, 2025. | Buy call option, expires at close of May 23, 2025. |

| Current Month | Ends this month, May 30, 2025. | Buy call option, expires at close of May 30, 2025. |

| Next Month | Ends next month, June 28, 2025. | Buy call option, expires at close of June 28, 2025. |

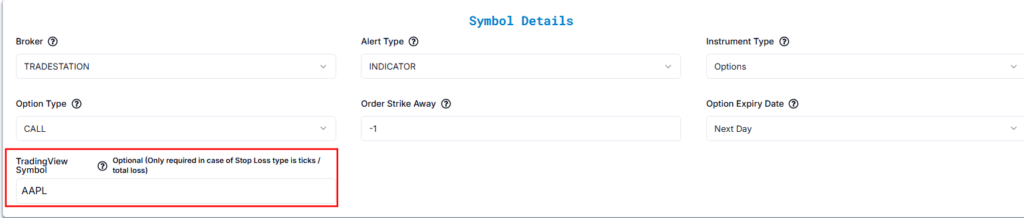

8. Enter the Correct TradingView Symbol for Accurate Mapping #

- TradingView Symbol:

AAPL - Use Case: Only required when your Stop Loss type is based on:

- Ticks

- Total Loss

- This field connects your TradingView strategy to the correct instrument for SL calculations.

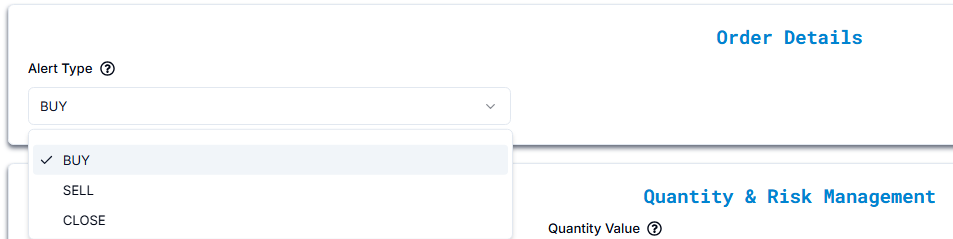

9. Choose Alert Type for TradingView – Buy, Sell, or Close #

| Setting | Explanation | Example |

| Buy | Opens a long position when the alert is triggered. | Buying a Call option on AAPL |

| Sell | Opens a short position when the alert is triggered. | Buying a Put option on TSLA |

| Close | Closes an existing position if one exists. | Closing a previously bought Call/Put |

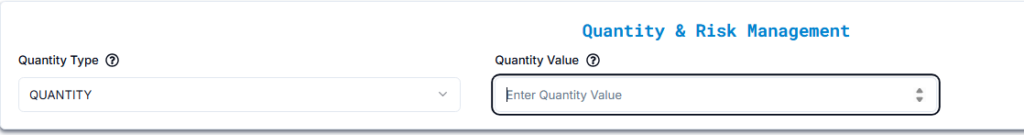

10. Set Trade Quantity and Risk Management in TradeStation Alerts #

Option A: Quantity #

- Quantity Type: QUANTITY

- Quantity Value: 1

Defines a fixed number of contracts for each trade.

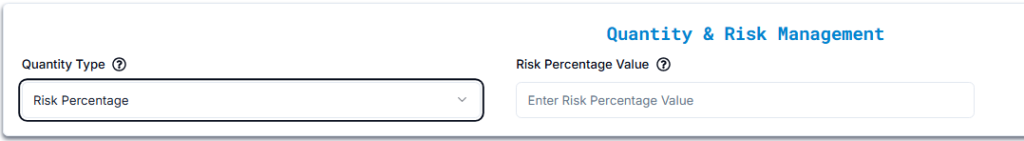

Option B: Risk Percentage #

- Quantity Type: RISK PERCENTAGE

- Value: e.g., 2%

When using Risk Percentage, the system calculates your trade size so that your maximum loss equals a fixed percentage of your total account balance, based on the stop-loss distance.

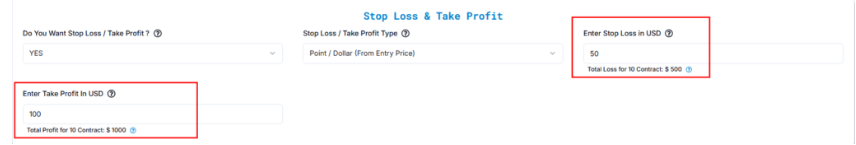

11. Define Stop Loss and Take Profit for Automated Option Alerts #

- Point / Dollar (From Entry Price)

Order Configuration:

- Stop Loss in USD: Customer manually inputs the dollar amount they are willing to risk on the trade ( in this example, we’ve chosen $50).

- Take Profit in USD: Customer manually inputs the dollar amount they aim to gain from the trade ( in this example, we’ve chosen $100).

How It Works:

- Stop Loss: The specified USD amount is subtracted from the entry price to determine the stop loss level. The total loss may vary depending on the number of shares.

- Take Profit: The specified USD amount is added to the entry price to determine the take profit level.

Settings and Examples:

Stop Loss (Point / Dollar From Entry Price):

- Setting: Enter the Stop Loss in USD. This amount determines how much you are willing to lose if the market moves against your position.

- Example: Buy AAPL at $239.07 with a Stop Loss at $189.07 ($50.00 below entry). Total loss: $50.00 × 1 (lot size) × 10 (number of shares) = $500.

Take Profit (Point / Dollar From Entry Price):

- Setting: Enter the Take Profit in USD. This amount sets your target gain if the market moves in your favor.

- Example: Buy AAPL at $239.07 with a Take Profit at $339.07 ($100.00 above entry). Total profit: $100.00 × 1 (lot size) × 10 (number of shares) = $1,000.

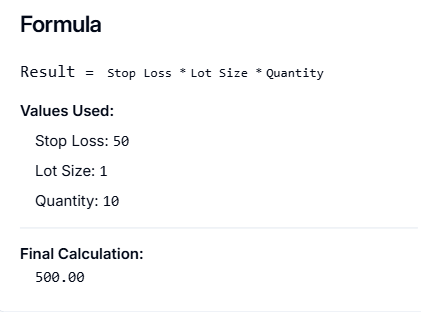

Calculation Details #

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula used

- The Values Entered by the user

- The Final Calculation result

Result Calculation:

Stop Loss Calculation:

- Formula: Stop Loss × Lot Size × Quantity

- Values Used:

- Stop Loss: $50

- Lot Size: 1

- Quantity: 10

Final Calculation: $50 × 1 × 10 = $500

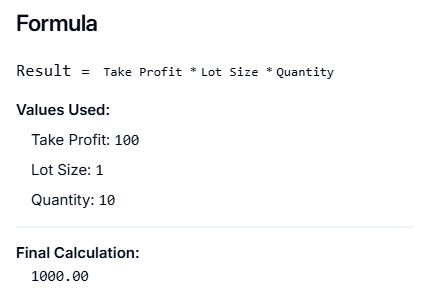

Take Profit Calculation:

- Formula: Take Profit × Lot Size × Quantity

- Values Used:

- Take Profit: $100

- Lot Size: 1

- Quantity: 10

- Final Calculation: $100 × 1 × 10 = $1,000

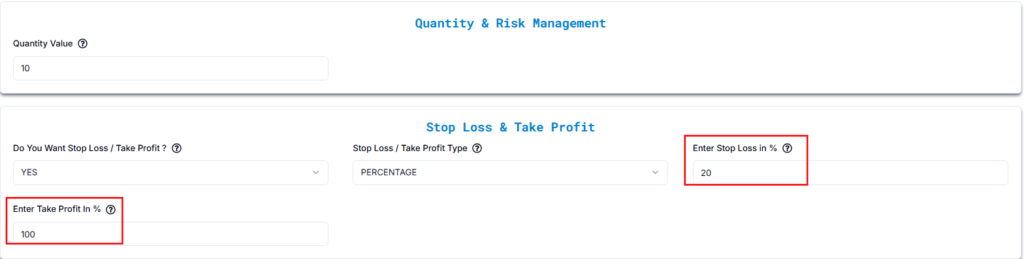

- Percentage

Order Configuration:

- Stop Loss in %: Customer manually inputs the percentage they are willing to risk on the trade (in this example, we’ve chosen 20%).

- Take Profit in %: Customer manually inputs the percentage they aim to gain from the trade (in this example, we’ve chosen 100%).

How It Works:

- Stop Loss: The specified percentage is calculated based on the entry price and subtracted to determine the stop loss level. The total loss varies depending on the entry price and lot size.

- Take Profit: The specified percentage is calculated based on the entry price and added to determine the take profit level.

Settings and Examples:

Stop Loss (Percentage):

- Setting: Enter the Stop Loss as a percentage of the entry price. If the market price falls by this percentage, the trade automatically closes to limit your loss.

- Example: Buy AAPL at $239.07 (Entry Price)

- Stop Loss: 20% below entry price

- 20% of $239.07 = $239.07 × 0.20 = $47.81

- Stop Loss Price = $239.07 − $47.81 = $191.26

Take Profit (Percentage):

- Setting: Enter the Take Profit as a percentage of the entry price. If the market price rises by this percentage, the trade automatically closes to secure your profit.

- Example: Buy AAPL at $239.07 (Entry Price)

- Take Profit: 100% above entry price

- 100% of $239.07 = $239.07 × 1.00 = $239.07

- Take Profit Price = $239.07 + $239.07 = $478.14

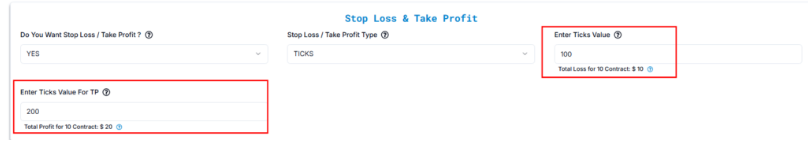

- Ticks

- AAPL Market Price: $239.07

- Tick Size: $0.01 (since AAPL trades in cents)

- Quantity: 10 contracts (I’m assuming each contract represents 1 share of AAPL — let me know if that’s different!)

Now for the Stop Loss & Take Profit:

- Stop Loss:

- Ticks: 100

- Tick Size: $0.01

- 100 ticks × $0.01 = $1.00

- Stop Loss Price: $239.07 − $1.00 = $238.07

- Total Loss Calculation:

- Loss per Tick: $0.01

- Quantity: 10 contracts

- Total Loss: 100 ticks × $0.01 × 10 = $10.00

- Take Profit:

- Ticks: 200

- Tick Size: $0.01

- 200 ticks × $0.01 = $2.00

- Take Profit Price: $239.07 + $2.00 = $241.07

- Total Profit Calculation:

- Profit per Tick: $0.01

- Quantity: 10 contracts

- Total Profit: 200 ticks × $0.01 × 10 = $20.00

So your numbers actually make total sense!

- Total Loss for 10 Contracts: $10.00

- Total Profit for 10 Contracts:$20.00

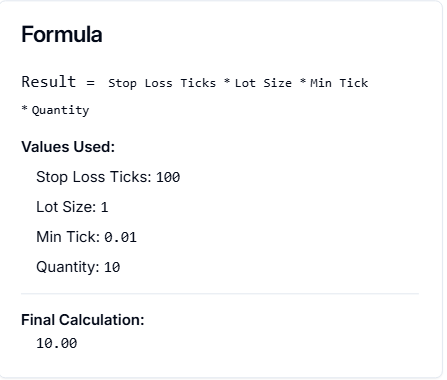

Calculation Details

Each field (Stop Loss, Take Profit, Trail Trigger, Trail Frequency) has a small question mark (?) icon next to it.

When you click the icon, it opens a “Calculation Details” popup, showing:

- The Formula used

- The Values Entered by the user

- The Final Calculation result

Formula for Stop Loss:Stop Loss Amount = Stop Loss Ticks × Lot Size × Min Tick × Quantity

Values:

Stop Loss Ticks: 100

Lot Size: 1

Min Tick: 0.01

Quantity: 10

Final Calculation:

Stop Loss Amount = 100 × 1 × 0.01 × 10 = 10.00

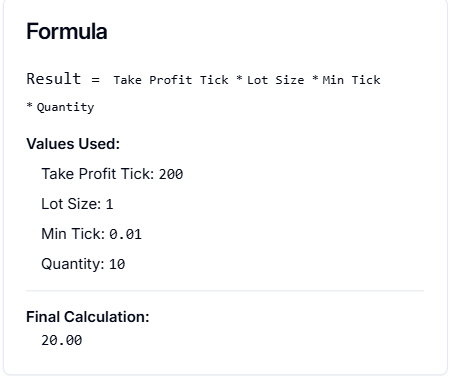

Formula for Take Profit:Take Profit Amount = Take Profit Ticks × Lot Size × Min Tick × Quantity

Values:

Take Profit Ticks: 200

Lot Size: 1

Min Tick: 0.01

Quantity: 10

Final Calculation:

Take Profit Amount = 200 × 1 × 0.01 × 10 = 20.00

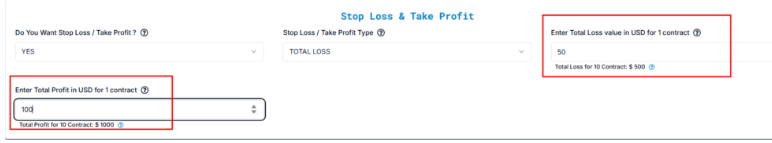

- Total Profit / Loss

Order Configuration:

- Total Loss per Contract: The total dollar amount of loss you’re willing to take per contract.

- Total Profit per Contract: The total dollar amount of profit you’re aiming for per contract.

AAPL Market Price: $239.07

Lot Size: 1 (1 contract = 1 share)

Quantity: 10 contracts

Total Loss (USD per Contract):

- Example: Let’s say you’re willing to lose $50 per contract.

- Total Contracts: 10

- Total Loss for 10 Contracts: $50 × 10 = $500

- Stop Loss Price Calculation:

- AAPL moves in $0.01 increments (min tick).

- $50 per contract ÷ $0.01 tick size = 5,000 ticks.

- Stop Loss Price: $239.07 − ($0.01 × 5,000) = $189.07

Total Profit (USD per Contract):

- Example: Let’s say you’re targeting $100 per contract.

- Total Contracts: 10

- Total Profit for 10 Contracts: $100 × 10 = $1,000

- Take Profit Price Calculation:

- $100 per contract ÷ $0.01 tick size = 10,000 ticks.

- Take Profit Price: $239.07 + ($0.01 × 10,000) = $339.07

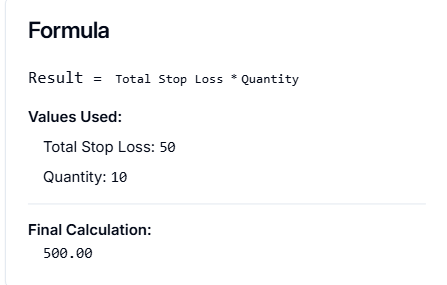

Formula for Total Take Profit:Total Profit Amount = Total Profit per Contract × Quantity

Values:

Total Profit per Contract: $100

Quantity: 10

Final Calculation:

Total Profit Amount = $100 × 10 = $1,000.00

Formula for Total Take Profit:Total Profit Amount = Total Take Profit per Contract × Quantity

Values:Total Take Profit per Contract: $100

Quantity: 10

Final Calculation:Total Profit Amount = $100 × 10 = $1,000.00

12. Account Selection and Configuration for TradeStation #

Once your alert and SL/TP settings are configured, the next step is selecting the trading account for execution. PickMyTrade supports both single-account and multi-account execution for TradeStation, with options for position sizing via Quantity Multiplier or Risk Percentage.

Would you like to add multiple accounts or select a specific account for trade execution?

Answer: YES

Upon selecting YES, additional configuration fields appear to let you connect your TradeStation accounts and define execution parameters.

12.1 Add TradeStation Account in Current PickMyTrade Account #

Use this configuration if you’re adding a TradeStation account to the PickMyTrade account you’re currently logged into.

| Field Name | Example Input | Explanation |

|---|---|---|

| PickMyTrade Conn. Name | TRADESTATION1 | Choose the correct connection name from the dropdown. It must match what you configured in PickMyTrade. |

| TRADESTATION Acc. Name | SIM155568455M | Select your TradeStation account. This must be linked to your current TradeStation login. |

| Option | QUANTITY MULTIPLIER | Choose your preferred position sizing method. |

| Qty Multiplier | 1 | A multiplier of 2 will double your trade size. E.g., 5 contracts × 2 = 10 contracts. |

Ensure the TradeStation account is already connected and synced within your PickMyTrade dashboard.

12.2 Add TradeStation Account to Another PickMyTrade Account #

Use this configuration if you’re managing multiple PickMyTrade logins and want to execute trades in a TradeStation account from a different PickMyTrade account (not the currently active one).

| Field Name | Example Input | Explanation |

|---|---|---|

| PickMyTrade Token | abcd1234xyz | Enter the token from the target PickMyTrade account you want to send trades to. |

| PickMyTrade Conn. Name | TRADESTATION1 | Define the connection name. It must match the TradeStation connection inside the target PickMyTrade account. |

| TRADESTATION Acc. Name | SIM155568455M | Enter the exact TradeStation account name as it appears in the terminal. |

| Option | QUANTITY MULTIPLIER | Choose your preferred position sizing method. |

| Qty Multiplier | 1 | A multiplier of 3 will triple your trade size. E.g., 2 contracts × 3 = 6 contracts. |

Make sure the PickMyTrade Token is valid and that the TradeStation connection exists in the destination account, or execution will fail.

Generate Alerts in TradingView for TradeStation Execution via PickMyTrade #

Click on “Generate Alert” #

After generating the alert, you’ll receive a JSON payload.

Next, follow the link below to learn how to set up your TradingView alert for automated trading:

Setting Up TradingView Alerts for Automated Trading

More Resources on Automating TradingView Alerts #

Want to automate trades on platforms beyond Rithmic, such as Interactive Brokers, TradeLocker, TradeStation, or ProjectX?

Explore all PickMyTrade setup guides

Using Tradovate instead?

View the Tradovate automation guide